NIFTY is at resistance level.

If it crosses 8340 then then further upward momentum is possible.

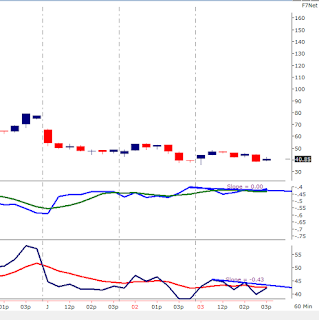

LT:

Larsen is showing strength. At very crucial level, crossing 1505-1510, could open gate till 1600 again.

Buy 1500 CALL between 47.5-49.30

Hold for couple of days.

SL 31

Target 73

Disclaimer: This blog does not take any responsibility of your profit/loss

If it crosses 8340 then then further upward momentum is possible.

LT:

Larsen is showing strength. At very crucial level, crossing 1505-1510, could open gate till 1600 again.

Buy 1500 CALL between 47.5-49.30

Hold for couple of days.

SL 31

Target 73

Disclaimer: This blog does not take any responsibility of your profit/loss