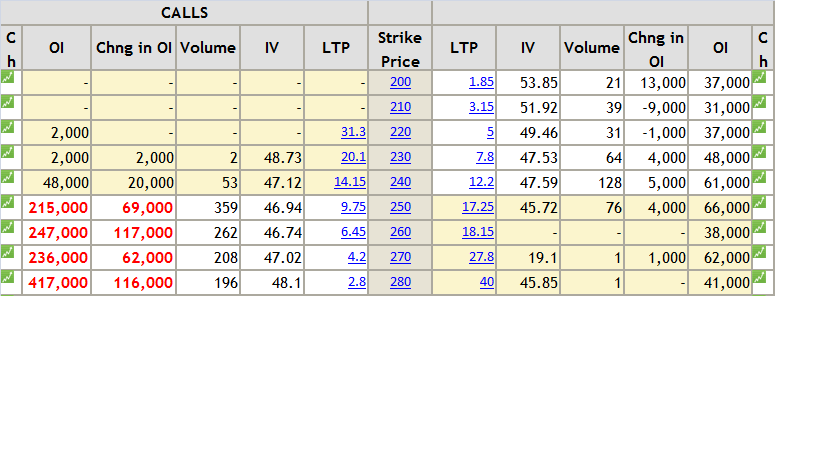

FIIs sold again in cash but bought huge in F & O segment.

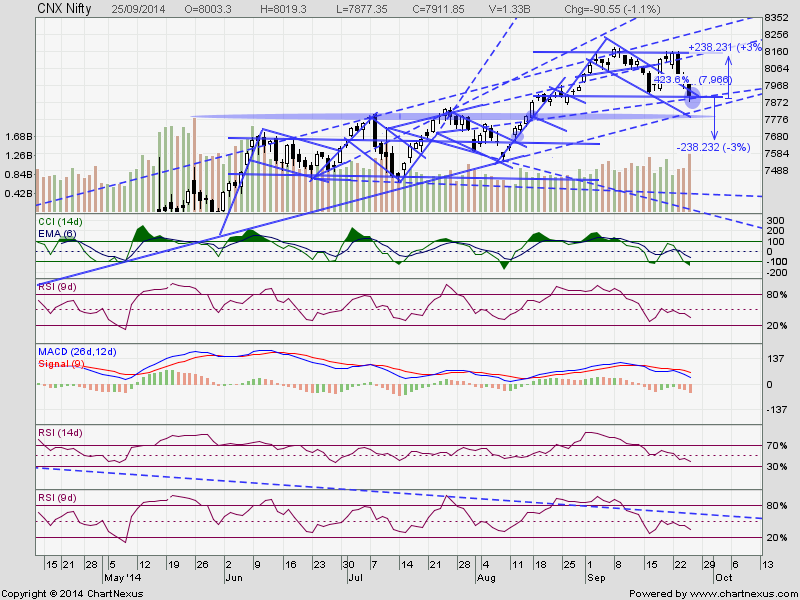

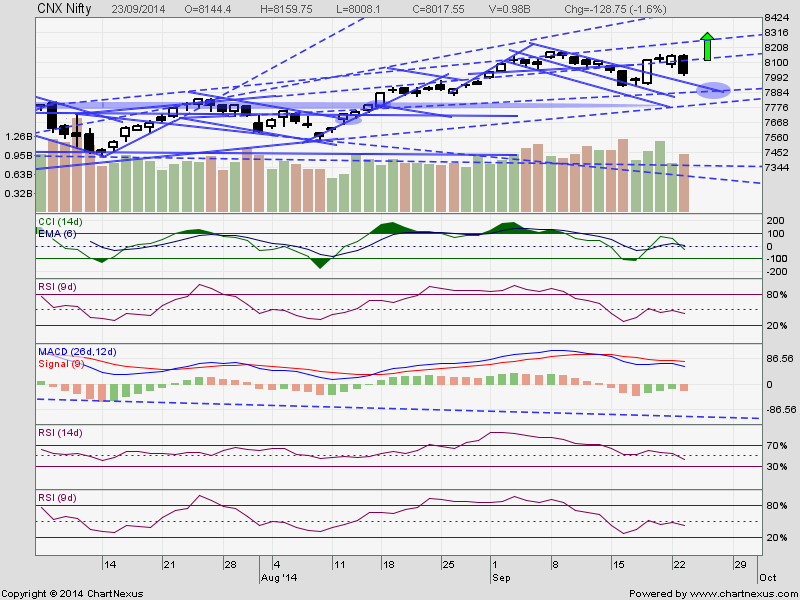

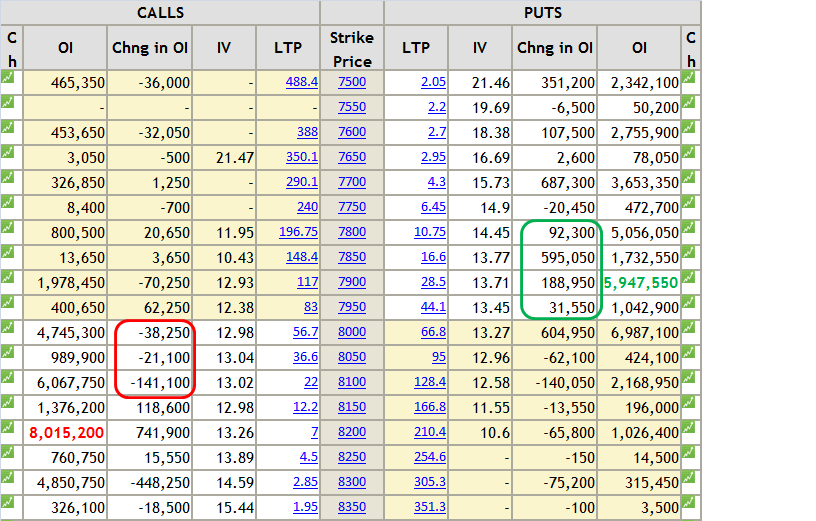

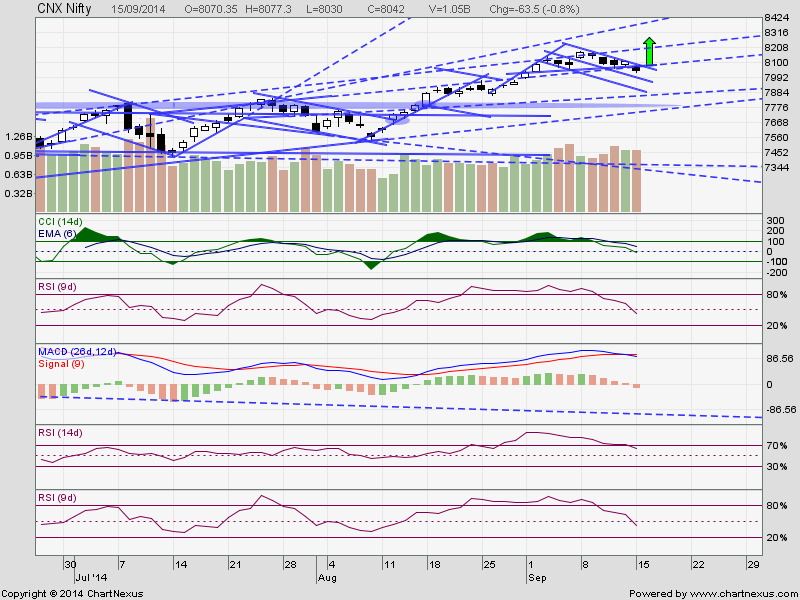

NIFTY has shown resilience to succumb to pressure again around 7920, and resistance around 8040. One can still be long till NIFTY does not go below 7840.

At the same time do not do any active buying unless NIFTY crosses 8040-8050.

Hold BankNIFTY 15500 CALL if not booked profit earlier.

Book profit in BANKINDIA 230 PUT around 18-19, if not booked earlier.

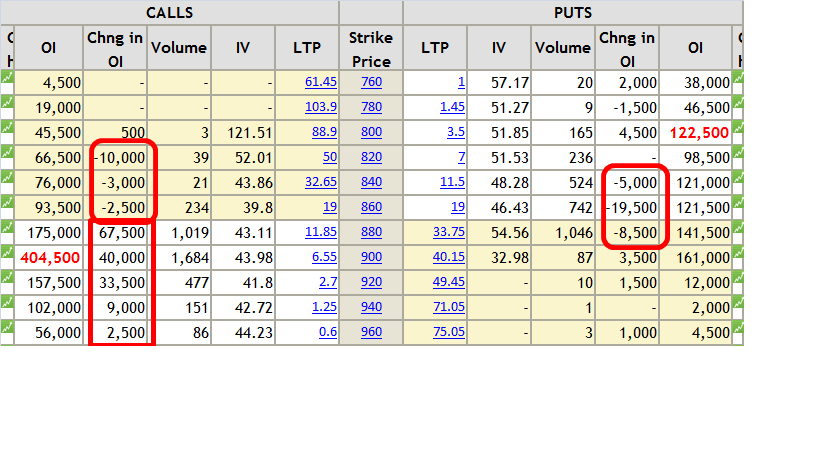

One may see some upside in early session because of lot of aggressive PUT writing. But since FIIs are selling, dollar index is at all time high, pressure on Rupee might not allow NIFTY to sustain at higher level.

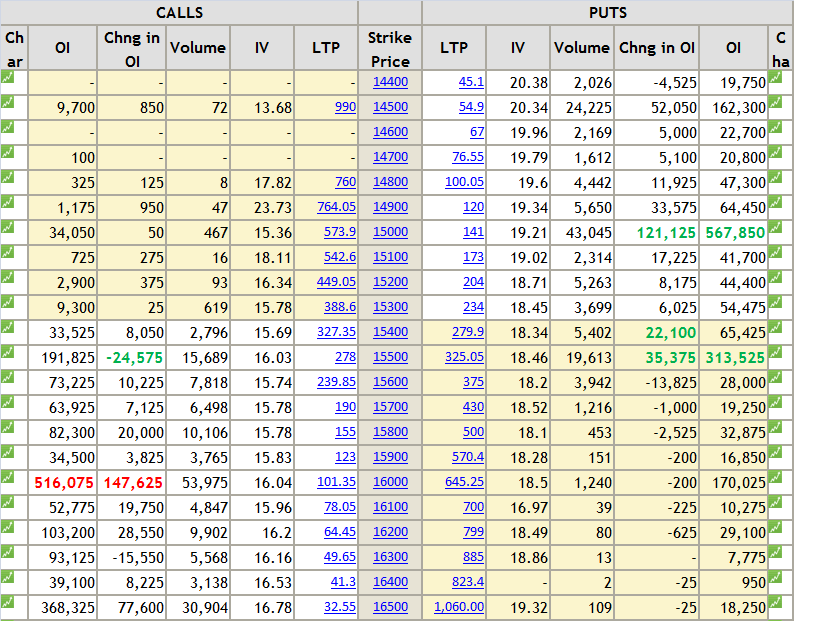

BANKNIFTY:

It might show gap up opening. OI additions in PUT and some long liquidation in ITM CALLs. This suggests slight strength during early hours if global cues are reasonably positive.

DLF:

It has touched trend-line. If it breaks it further, there won't be any support. If NIFTY corrects by 5% from here, DLF could touch August 2013 low ie 120. Below 120, it could go anywhere.

One can trade this way in following ways:

Disclaimer: This blog does not take responsibility of your profit/loss.

NIFTY has shown resilience to succumb to pressure again around 7920, and resistance around 8040. One can still be long till NIFTY does not go below 7840.

At the same time do not do any active buying unless NIFTY crosses 8040-8050.

Hold BankNIFTY 15500 CALL if not booked profit earlier.

Book profit in BANKINDIA 230 PUT around 18-19, if not booked earlier.

One may see some upside in early session because of lot of aggressive PUT writing. But since FIIs are selling, dollar index is at all time high, pressure on Rupee might not allow NIFTY to sustain at higher level.

BANKNIFTY:

It might show gap up opening. OI additions in PUT and some long liquidation in ITM CALLs. This suggests slight strength during early hours if global cues are reasonably positive.

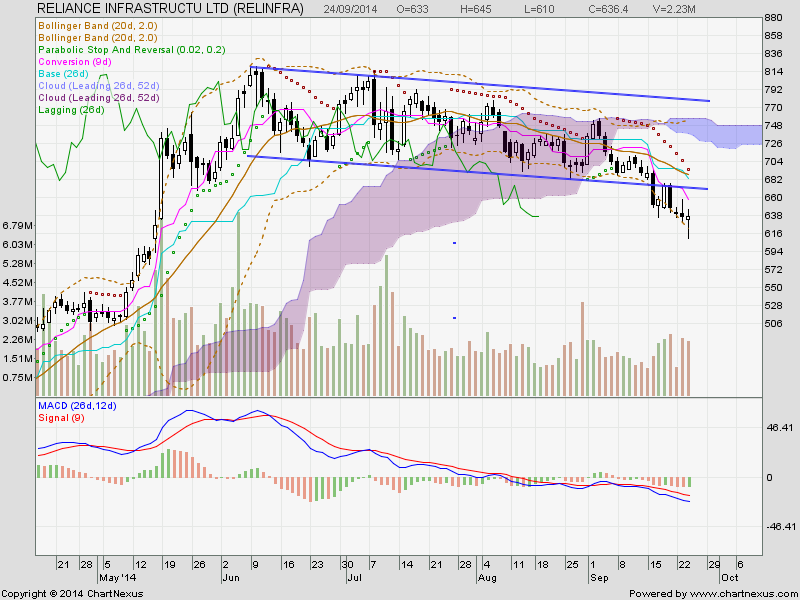

DLF:

It has touched trend-line. If it breaks it further, there won't be any support. If NIFTY corrects by 5% from here, DLF could touch August 2013 low ie 120. Below 120, it could go anywhere.

One can trade this way in following ways:

- Most risky sell Future unlimited loss and unlimited profit potential. Use strict SL of 2% OR

- Less risky Buy 135 PUT around 2, maximum loss Rs. 4000/- OR

- More safe: Buy 135 PUT around 2 and Sell 130 PUT around 1.40. Maximum loss Rs. 1200 and maximum profit potential Rs. 7800/-

Disclaimer: This blog does not take responsibility of your profit/loss.