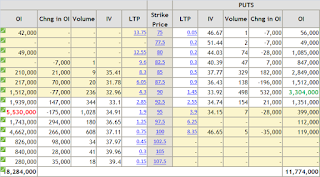

NIFTY has very strong supply zone around 7640 and it might not be crossed very easily.

One should wait for trade in NIFTY till the clarity in direction.

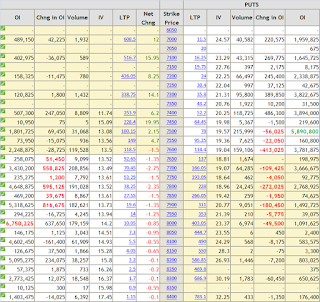

INFY

One can buy INFY 1160 CALL and sell 1220 CALL.

Maximum loss could be around 11000/- but profit potential is Rs. 20000/-

One should wait for trade in NIFTY till the clarity in direction.

INFY

One can buy INFY 1160 CALL and sell 1220 CALL.

Maximum loss could be around 11000/- but profit potential is Rs. 20000/-

Falling Rupee could help the stock. Retracement and Cup and Saucer pattern should take the stock to 1220-1230 level very soon.

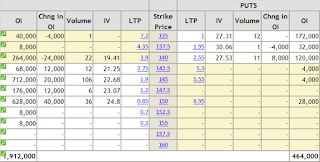

Reliance Capital.

There could be very quick trade here.

RSI cross over has happened very recently. Stock is near oversold region.

Stock has turn back yesterday from 389-90 region, which was 38% retracement from last fall. If it crosses 390/- then for short term target should be 405 and then 422/-

Buy 390 CALL around 19.20-19.50.

Exit on same day and book profit.

Disclaimer: This blog does not take any responsibility of your profit/loss.