Monday 30 March 2015

Thursday 26 March 2015

Reliance and SAIL

Hold YESBANK strategy. One can book profit in CALL sell contract of YESBANK and hold other positions.

Reliance:

Reliance broke long term support line with high volume and it could slide down further.

Market must support for Reliance to cross 900. If NIFTY goes beyond 8790 in near future, Reliance could take off, otherwise it will fall further or will consolidate in present range.

Sell Reliance 900 CALL of April expiration around Rs. 6/- one can do in 2 lots.

SAIL

SAIL has given clear break out in falling markets.

It could give some more upside.

Even in bear market 65 acted as rock solid support.

Sell 65 PUT of SAIL of April expiration around 1.30-1.40

Disclaimer: This blog does not take any responsibility of your profit/loss

Reliance:

Reliance broke long term support line with high volume and it could slide down further.

Market must support for Reliance to cross 900. If NIFTY goes beyond 8790 in near future, Reliance could take off, otherwise it will fall further or will consolidate in present range.

Sell Reliance 900 CALL of April expiration around Rs. 6/- one can do in 2 lots.

SAIL

SAIL has given clear break out in falling markets.

It could give some more upside.

Even in bear market 65 acted as rock solid support.

Sell 65 PUT of SAIL of April expiration around 1.30-1.40

Disclaimer: This blog does not take any responsibility of your profit/loss

Tuesday 24 March 2015

Sell JSW STEEL 920 CALL around 6-7 and Sell LUPIN 2000 PUT around 12

Tomorrow is expiry day.

No lottery trade this month.

Markets are behaving pattern. If in up trend, NIFTY should revert soon. But it is not happening. FIIs are mainly buyers but NIFTY is not responding to their buying! This is unusual.

Sell JSW STEEL 920 CALL around 6-7 and Sell LUPIN 2000 PUT around 12.

Please enter in trades in limit value as these are not liquid options.

Disclaimer: This blog does not take any responsibility of your profit/loss

No lottery trade this month.

Markets are behaving pattern. If in up trend, NIFTY should revert soon. But it is not happening. FIIs are mainly buyers but NIFTY is not responding to their buying! This is unusual.

Sell JSW STEEL 920 CALL around 6-7 and Sell LUPIN 2000 PUT around 12.

Please enter in trades in limit value as these are not liquid options.

Disclaimer: This blog does not take any responsibility of your profit/loss

Sunday 22 March 2015

Trades for next few days

NIFTY is in downward trend.

It must cross 8780-8790 conclusively on EOD basis for further up-move.

Bank NIFTY is struggling more than NIFTY.

SBI is in down trend.

Trading around 275/-, it will be difficult for SBI to cross 320 in near future.

Sell two lots of 320 CALL contracts around 2/- of April expiration.

This will add credit balance of about Rs. 2500/- in your account.

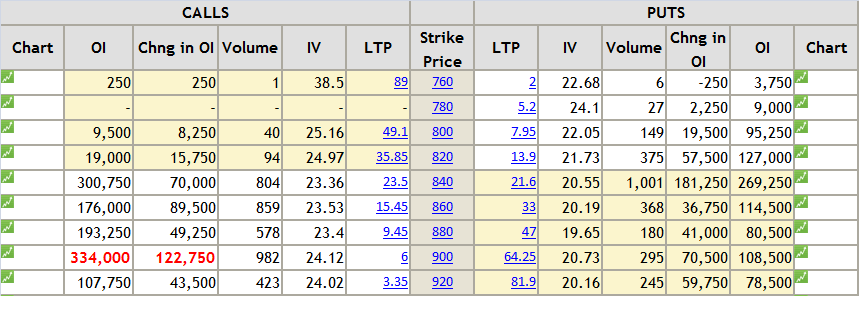

Yes Bank:

Though it is corrected by Rs. 120, stock is recovering in past couple of days and is consolidating.

Yes Bank has strong support around 760/-

Sell Yes bank 760 PUT of April expiration around 8/-

Sell Yes Bank 920 CALL of April expiration around 9/-

Buy Yes Bank 860 CALL of April expiration around 25/-

This will not take more than Rs. 1500/- from your pocket.

This looks to be reasonably safe strategy. One should exit from the strategy if YESBANK goes below 760 in cash, with very marginal loss.

In short trades should be as below:

Sell two lots of 320 CALL of SBIN around 2/- of April expiration.

Sell Yes bank 760 PUT of April expiration around 8/-

Sell Yes Bank 920 CALL of April expiration around 9/-

Buy Yes Bank 860 CALL of April expiration around 25/-

Disclaimer: This blog does not take any responsibility of your profit/loss.

It must cross 8780-8790 conclusively on EOD basis for further up-move.

Bank NIFTY is struggling more than NIFTY.

SBI is in down trend.

Trading around 275/-, it will be difficult for SBI to cross 320 in near future.

Sell two lots of 320 CALL contracts around 2/- of April expiration.

This will add credit balance of about Rs. 2500/- in your account.

Yes Bank:

Though it is corrected by Rs. 120, stock is recovering in past couple of days and is consolidating.

Yes Bank has strong support around 760/-

Sell Yes bank 760 PUT of April expiration around 8/-

Sell Yes Bank 920 CALL of April expiration around 9/-

Buy Yes Bank 860 CALL of April expiration around 25/-

This will not take more than Rs. 1500/- from your pocket.

This looks to be reasonably safe strategy. One should exit from the strategy if YESBANK goes below 760 in cash, with very marginal loss.

In short trades should be as below:

Sell two lots of 320 CALL of SBIN around 2/- of April expiration.

Sell Yes bank 760 PUT of April expiration around 8/-

Sell Yes Bank 920 CALL of April expiration around 9/-

Buy Yes Bank 860 CALL of April expiration around 25/-

Disclaimer: This blog does not take any responsibility of your profit/loss.

Friday 13 March 2015

Sell in May and go away!!

NIFTY could be in range bound zone in spite of FOMC meeting on March 18.

Strategy for next few days:

Sell 8800 CALL of March expiration and sell 8800 PUT of March expiration. Do sell 2 lots each.

About Rs. 10000/- will be credited to your trading account.

Sell in May and go away!!

FOMC meeting in May could lead to rate hike and could bring some panic among traders.

Keep buying 8500 and 8600 PUTs of May expiration on every rise in NIFTY spot. Make basket of total 6-8 lots of PUTs, investing about 12000-15000/-

Disclaimer: This blog does not take any responsibility of your profit/loss

Strategy for next few days:

Sell 8800 CALL of March expiration and sell 8800 PUT of March expiration. Do sell 2 lots each.

About Rs. 10000/- will be credited to your trading account.

Sell in May and go away!!

FOMC meeting in May could lead to rate hike and could bring some panic among traders.

Keep buying 8500 and 8600 PUTs of May expiration on every rise in NIFTY spot. Make basket of total 6-8 lots of PUTs, investing about 12000-15000/-

Disclaimer: This blog does not take any responsibility of your profit/loss

Sunday 8 March 2015

Trades for next week

NIFTY is now clearly entering in to consolidation mode before next directional movement.

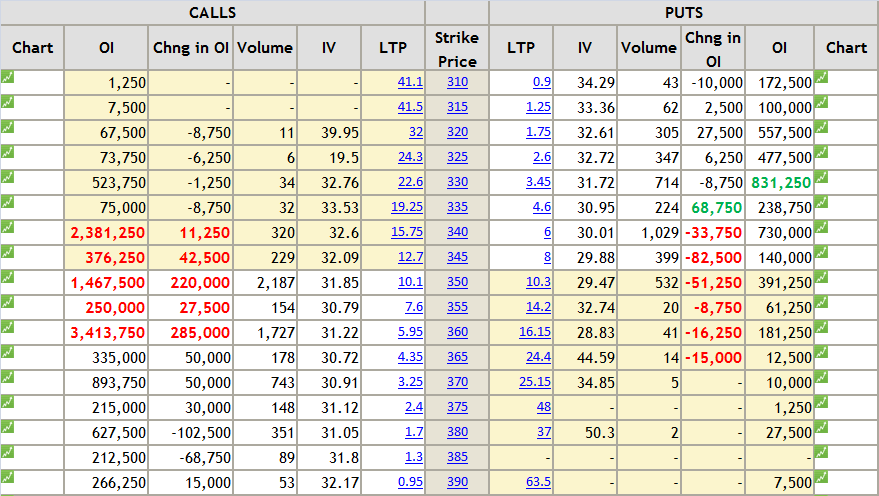

From OI table, 8750-9120 could be the range for short term and chart suggests, if NIFTY slips below 8780-8750 range, then further downside is possible.

One should monitor OI table of NIFTY daily and adjust positions based on direction provided by smart money movers for better accuracy.

Lot of PUT writing at 8900 contract, which is trading near 80/-, it means even if there is gap down opening, crossing 8820 could be difficult for NIFTY immediately on Monday. For day trader 8820 (SPOT) could be a buying opportunity with 25-30 points stop loss.

General trend is still positive.

ICICIBANK

Stock is in down trend. But lot of PUT addition around 330, suggests con can safely write 325 PUT around 3.50-4.50/-

Chart suggests strong support near 327.

TATAMOTORS:

Strong support near 560-566. TATA group stocks are generally doing well.

Lot of PUT writing in 550 contract and hence one can safely write 540 PUT around 4-5.

AXISBANK

Traders seems to be on both sides of trades once it comes to trading in AXISBANK stock.

Look at OI table. Though there are more reds than green, there is still merit to be with bulls.

Stock should cross 650 cross before expiration.

Buy 650 CALL of axis bank around 8-9.

CAIRN

Stock is in down trend and hence worth trying PUT buying here. If double top pattern works, stock should reach 220 level before weekend.

Buy 235 PUT around 4-5/-

In short trends for next week as follows:

Disclaimer: This blog does not take any responsibility of your profit/loss.

From OI table, 8750-9120 could be the range for short term and chart suggests, if NIFTY slips below 8780-8750 range, then further downside is possible.

One should monitor OI table of NIFTY daily and adjust positions based on direction provided by smart money movers for better accuracy.

Lot of PUT writing at 8900 contract, which is trading near 80/-, it means even if there is gap down opening, crossing 8820 could be difficult for NIFTY immediately on Monday. For day trader 8820 (SPOT) could be a buying opportunity with 25-30 points stop loss.

General trend is still positive.

ICICIBANK

Stock is in down trend. But lot of PUT addition around 330, suggests con can safely write 325 PUT around 3.50-4.50/-

Chart suggests strong support near 327.

TATAMOTORS:

Strong support near 560-566. TATA group stocks are generally doing well.

Lot of PUT writing in 550 contract and hence one can safely write 540 PUT around 4-5.

AXISBANK

Traders seems to be on both sides of trades once it comes to trading in AXISBANK stock.

Look at OI table. Though there are more reds than green, there is still merit to be with bulls.

Stock should cross 650 cross before expiration.

Buy 650 CALL of axis bank around 8-9.

CAIRN

Stock is in down trend and hence worth trying PUT buying here. If double top pattern works, stock should reach 220 level before weekend.

Buy 235 PUT around 4-5/-

In short trends for next week as follows:

- Sell two lots of ICICIBANK 325 PUT contracts around 3.50-4.50.

- Sell two lots of TATAMOTORS 540 PUT contracts around 4-5

- Buy Axis Bank 650 CALL

- Buy CAIRN 335 PUT

Disclaimer: This blog does not take any responsibility of your profit/loss.

Subscribe to:

Posts (Atom)