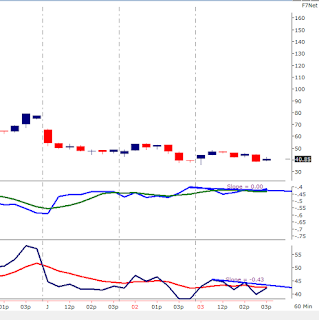

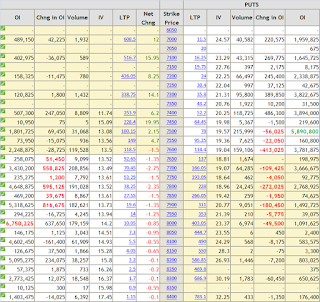

NIFTY is moving sideways.

This is good for option writers.

Sell NIFTY 7400 CALL at market price around 200-230.

Sell 2 lots. This will accumulate (wealth?) around Rs. 30 K to 35 K in your trading account.

Presently option is being traded below 61 day EMA level. It could cross EMA line when it would close above 280-285 on EOD basis. This 280-285 range also should be the stop loss for the trade.

Aditya Birla NUVO.

This stock is moving sideways and awaiting RSI breakout or just at the verge of breakout which it could complete once it crosses 843.40.

Buy this stock above 843.40-844 in future segment,

This stock is very volatile, if it slips below 815, then do not think twice, please exit. But be in trade till it is above 61 HEMA level, for tomorrow 61 HEMA level could be around 815. This is very rough judgement merely looking at present graph and with no scientific calculation involved.

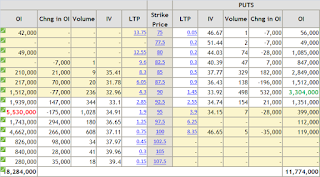

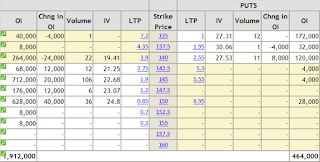

Centurytex

This stock also has given RSI breakout in hourly chart.

Target could be near 620 if pattern works.

CCI is about to cross 100 mark, if it does so, stock will show very good momentum in northward direction.

But looking at present uncertainly, insure the trade by buying 580 PUT. Maximum loss could be Rs. 15000/-. those who can afford, can sell 620 CALL along with buying of 580 PUT. This will limit the profit, but loss will be confined to Rs. 10000/-

Recommendation could be buy future and 580 PUT, and work with SL 550 (EOD) for tomorrow.

Disclaimer: This blog does not take any responsibility of your profit/loss