Today was an unusual trading day. Market did not react to rate hike by FED! All market pundits are now stating 25 to 50 bps rate hike by FED was anticipated or was known to everybody and hence all markets in world have gone up. This does not gel. In all previous local and global such experiences/events, at least there was a strong knee-jerk reaction. What was different this time? Wasn't this a mega event? So I think real reaction is yet to come. And now it will come slowly but decisively.

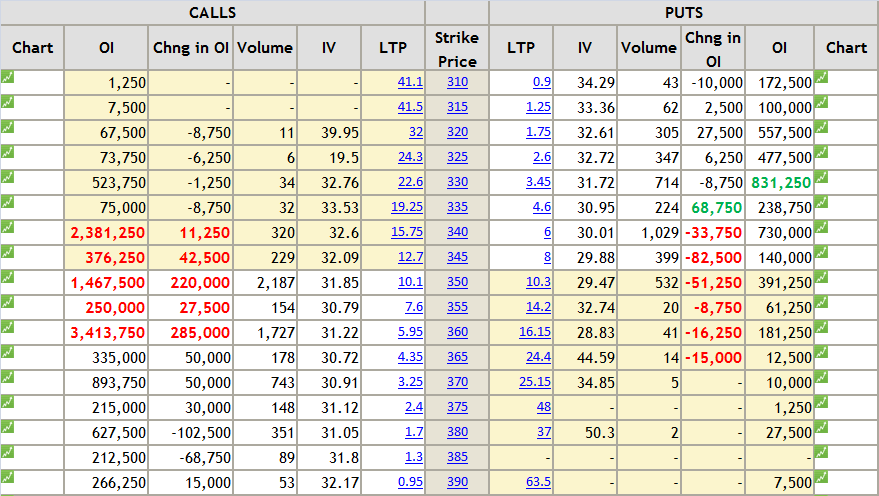

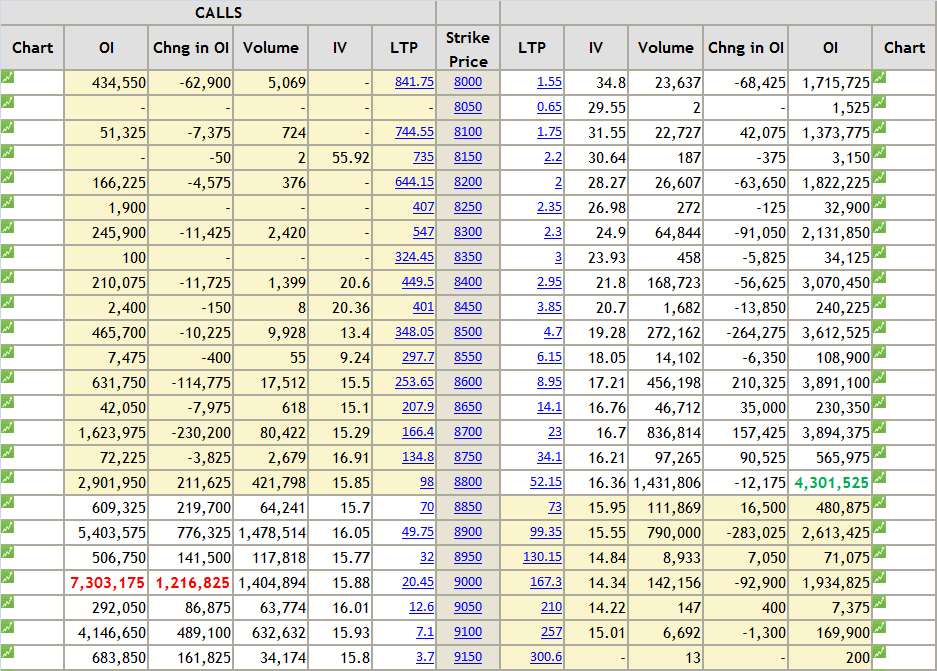

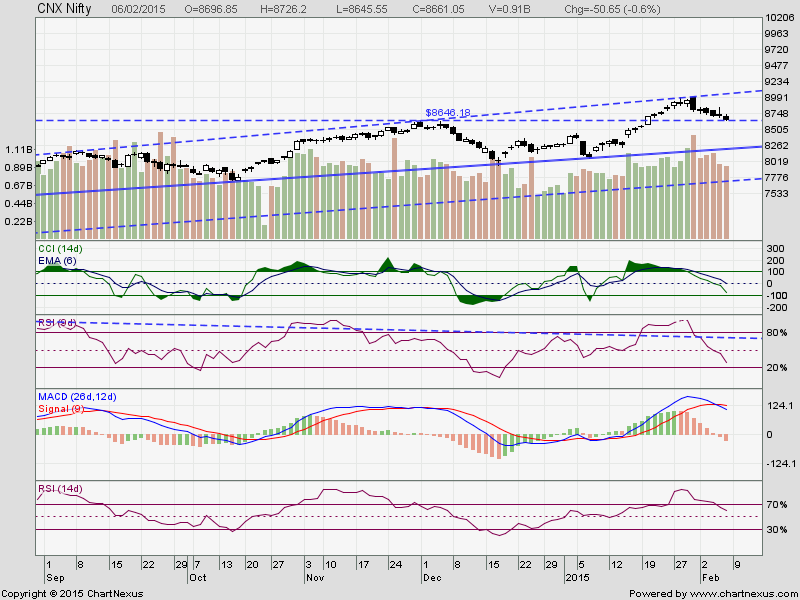

Also 7850-7874 is another wall and supply zone. All indicators are in overbought zone, so either there will be time correction or price correction, before NIFTY moves upward again.

So our strategy should be:

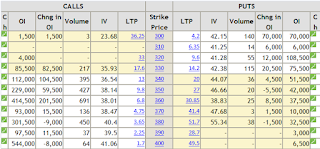

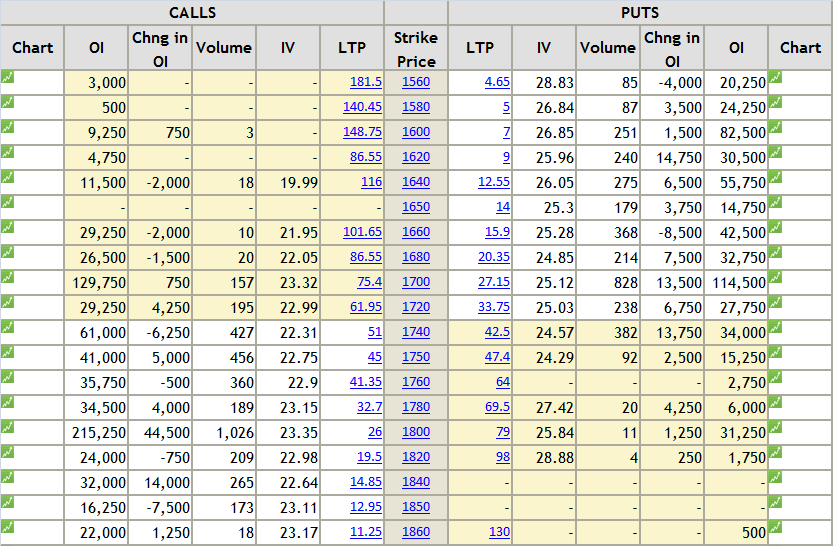

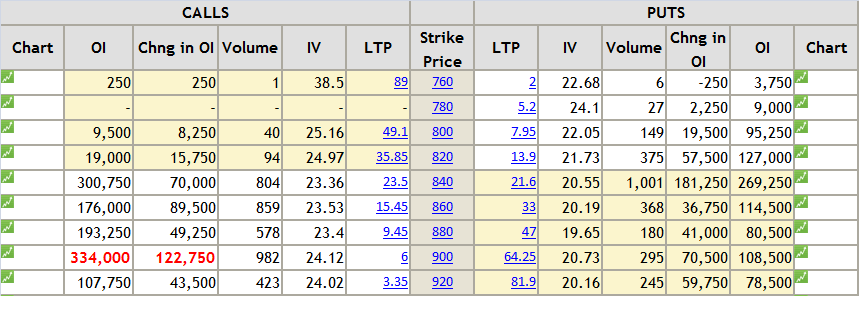

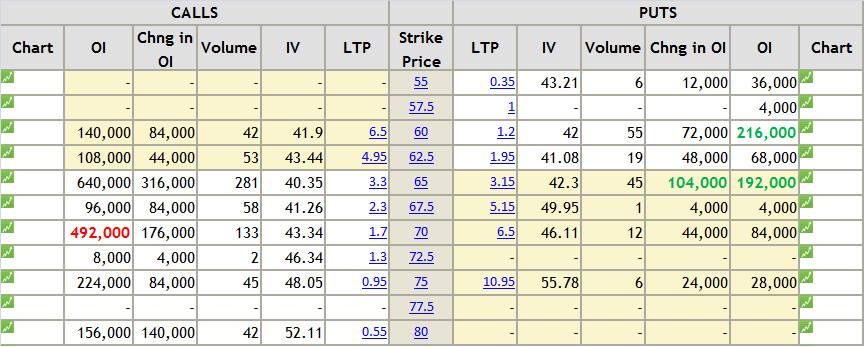

Sell NIFTY 2 lots 7600 CALLs around 260-270.

Sell NIFTY 2 lots 7800 CALLs around 105-115.

Stop loss should be Rs. 10000/- for each contract.

FIIs bought huge in cash segment today after lot of gap and DIIs were net sellers. This is not good signal for bears. If this continues tomorrow we have to exit soon.

One should try and hold these positions for couple of days. Because rate hike implications will be evaluated by all traders rationally by then. For a layman, rate hike by FED will make dollar dearer, it means for us Rupee will depreciate further. It could cross 70 soon. Inflation would go up as India is net importer. Falling oil prices might not be too beneficial because drop in oil price will be compensated by falling Rupee. So in broad term I see some negativity and it should reflect in NIFTY during next week.

Disclaimer: This blog does not take responsibility of your profit/loss

Also 7850-7874 is another wall and supply zone. All indicators are in overbought zone, so either there will be time correction or price correction, before NIFTY moves upward again.

So our strategy should be:

Sell NIFTY 2 lots 7600 CALLs around 260-270.

Sell NIFTY 2 lots 7800 CALLs around 105-115.

Stop loss should be Rs. 10000/- for each contract.

FIIs bought huge in cash segment today after lot of gap and DIIs were net sellers. This is not good signal for bears. If this continues tomorrow we have to exit soon.

One should try and hold these positions for couple of days. Because rate hike implications will be evaluated by all traders rationally by then. For a layman, rate hike by FED will make dollar dearer, it means for us Rupee will depreciate further. It could cross 70 soon. Inflation would go up as India is net importer. Falling oil prices might not be too beneficial because drop in oil price will be compensated by falling Rupee. So in broad term I see some negativity and it should reflect in NIFTY during next week.

Disclaimer: This blog does not take responsibility of your profit/loss