Thursday 30 October 2014

Wednesday 29 October 2014

IDFC

Lottery trade

Buy IDFC 155 CALL around 0.20-0.30. Target 1.00

Disclaimer: This blog does not take any responsibility of your profit/loss

Buy IDFC 155 CALL around 0.20-0.30. Target 1.00

Disclaimer: This blog does not take any responsibility of your profit/loss

Wednesday 15 October 2014

Buy PUTs in NIFTY 7900 and 7800 contracts

DLF turned out to be trade of the year. Mega-profit!!

Those who were holding 135 PUTs of DLF are dip in the money! Real Diwali. We closed most of our positions for the month and will not take any major positions till next week.

Election volatility, anxiety will be over by then.

FIIs are continuously selling for last two weeks.

Macro data is much better this month than last month. In fact in last month, even though macro data was bad NIFTY achieved new highs. Hence it is clear, so far FIIs do not care about micro-macro-Modi factor etc.

Low crude prices improving macro data across the world. In US inflation and budget deficit are at their multi-year best and US will be considered one of the best economies among developed economies.

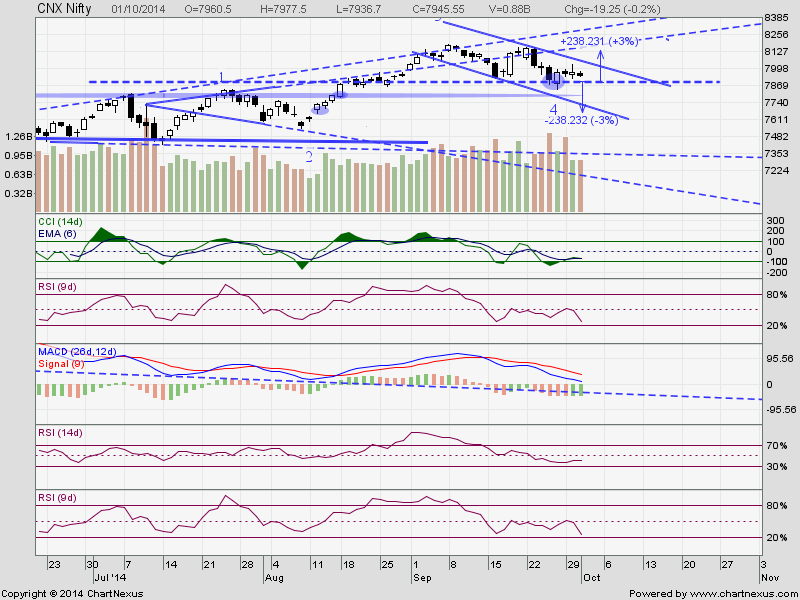

For bulls tomorrow 7912 is an important number. Do not buy anything unless NIFTY crosses 7912 in spot. See below graph and blue dot.

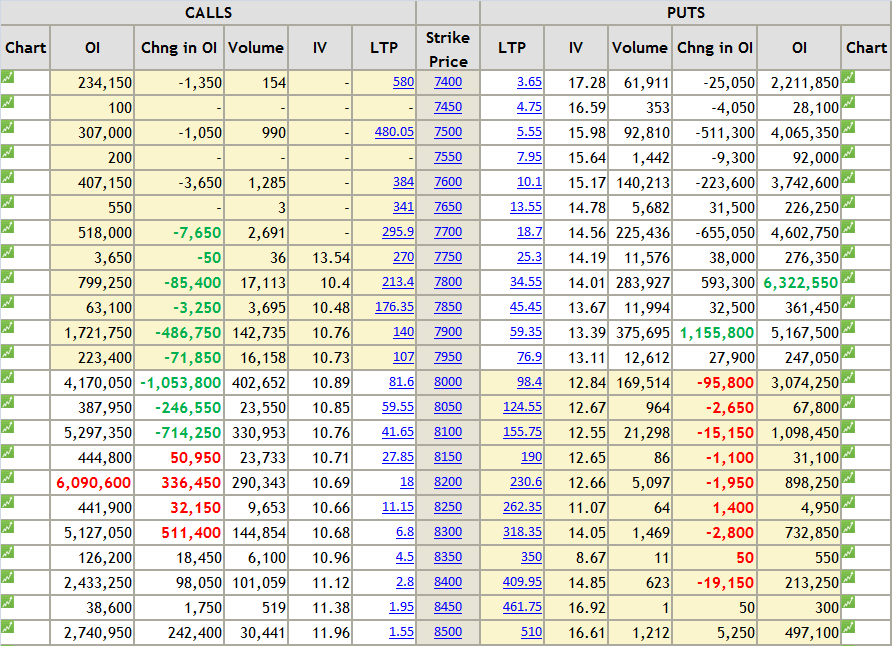

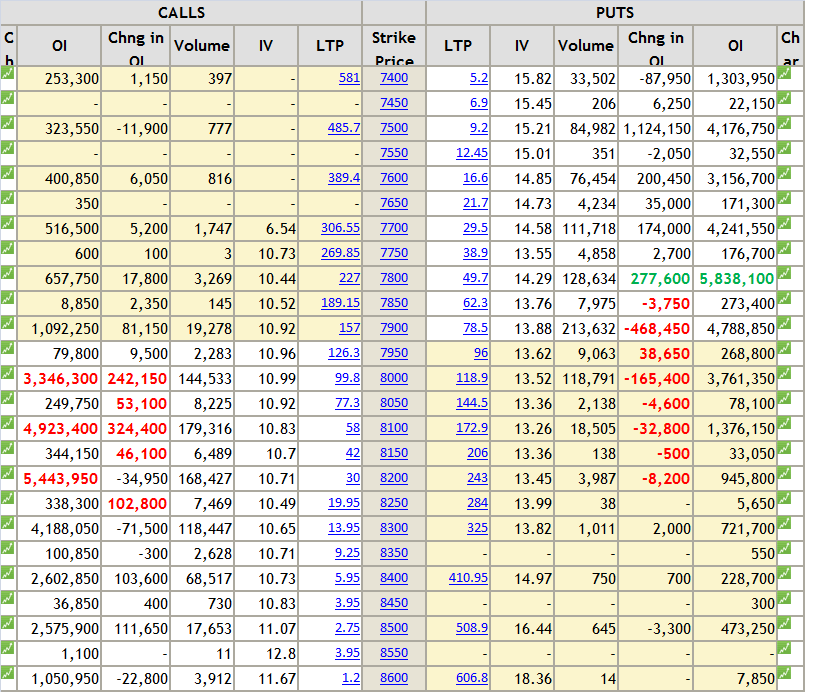

In option table there are more reds than greens, indicating smart option traders are not very positive on NIFTY at the moment. But still 7800 is seems to be strong support.

Buy PUTs in NIFTY 7900 and 7800 contracts for tomorrow. One can hold too, if risk appetite and profit of this month's permit, NIFTY could slide down to 7650 post Diwali.

Keep booking small profits.

Hold bank of India 230 PUT, if not booked profit earlier.

Next post will be on October 21.

Till then happy trading and enjoy Diwali preparations.

Disclaimer: This blog does not take any responsibility of your profit/loss

Those who were holding 135 PUTs of DLF are dip in the money! Real Diwali. We closed most of our positions for the month and will not take any major positions till next week.

Election volatility, anxiety will be over by then.

FIIs are continuously selling for last two weeks.

Macro data is much better this month than last month. In fact in last month, even though macro data was bad NIFTY achieved new highs. Hence it is clear, so far FIIs do not care about micro-macro-Modi factor etc.

Low crude prices improving macro data across the world. In US inflation and budget deficit are at their multi-year best and US will be considered one of the best economies among developed economies.

For bulls tomorrow 7912 is an important number. Do not buy anything unless NIFTY crosses 7912 in spot. See below graph and blue dot.

In option table there are more reds than greens, indicating smart option traders are not very positive on NIFTY at the moment. But still 7800 is seems to be strong support.

Buy PUTs in NIFTY 7900 and 7800 contracts for tomorrow. One can hold too, if risk appetite and profit of this month's permit, NIFTY could slide down to 7650 post Diwali.

Keep booking small profits.

Hold bank of India 230 PUT, if not booked profit earlier.

Next post will be on October 21.

Till then happy trading and enjoy Diwali preparations.

Disclaimer: This blog does not take any responsibility of your profit/loss

Monday 13 October 2014

No new trades

FIIs are selling and DII are buying. FIIs sold huge in cash and F & O. NIFTY went up by about 100 points from the bottom. Are DIIs knowing more than FIIs this time?

Level 7820-7840 again proved to be important. But still, do not buy till NIFTY spot crosses 7940. Let us see whether FIIs turn net buyers tomorrow and then take buy positions.

Option table clearly indicates predominantly CALL buying and PUT selling, and this makes a case for further upside.

Support at 7800 and resistance at 8200.

No new trades. Hold bear positions till NIFTY convincingly closes above 7940 on EOD basis.

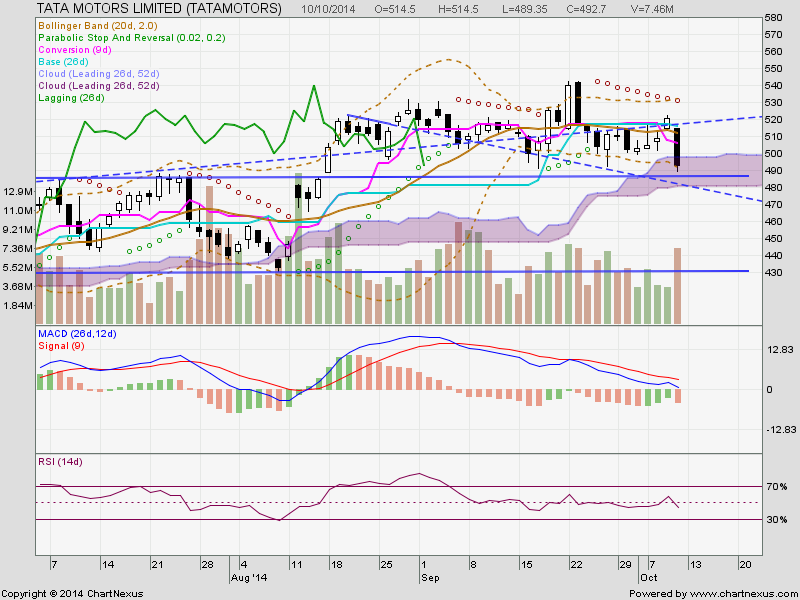

TATAMOTORS:

It showed hammer pattern today. A bullish signal. If one sees follow up buying tomorrow and close above EOD today then exit the strategy at around EOD at cost or at small loss.

Disclaimer: This blog does not take any responsibility of your profit/loss.

Level 7820-7840 again proved to be important. But still, do not buy till NIFTY spot crosses 7940. Let us see whether FIIs turn net buyers tomorrow and then take buy positions.

Option table clearly indicates predominantly CALL buying and PUT selling, and this makes a case for further upside.

Support at 7800 and resistance at 8200.

No new trades. Hold bear positions till NIFTY convincingly closes above 7940 on EOD basis.

TATAMOTORS:

It showed hammer pattern today. A bullish signal. If one sees follow up buying tomorrow and close above EOD today then exit the strategy at around EOD at cost or at small loss.

Disclaimer: This blog does not take any responsibility of your profit/loss.

Sunday 12 October 2014

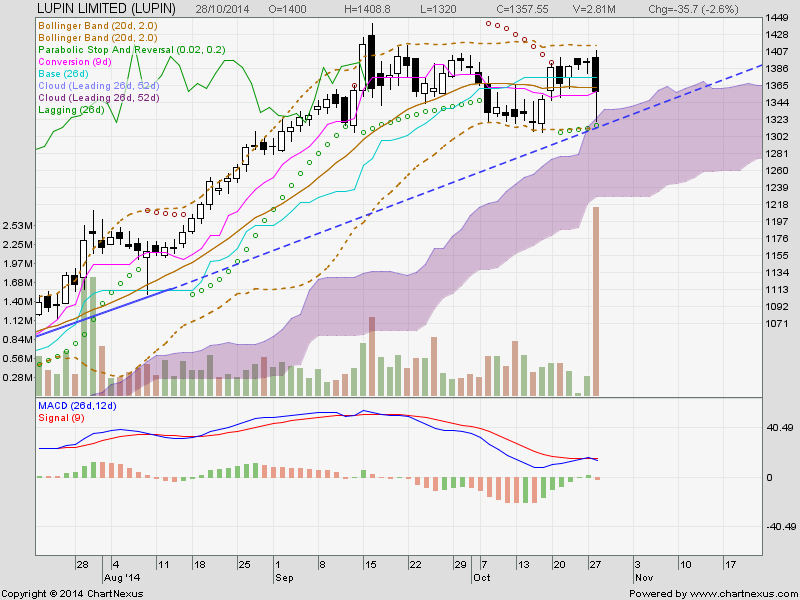

NIFTY, TATAMOTORS and APOLLOTYRES

NIFTY

FIIs are selling in huge quantities and DIIs are buying in equal quantities. NIFTY is not giving any direction. But fundamental rule in trading is one must have one view. Obviously one should be either bullish or bearish.

NIFTY is very near to support level ( 7840-7820), if it goes below 7800, one could see stiff downside till 7650. One could see reversal in short term down-trend from current level. However, one should not do any buying unless NIFTY crosses 7970-7975. See chart.

In OI table one could see more of red spots than green. But still OI analysis is inconclusive. IVs of PUTs and CALLs have gone up. In percentage terms IVs of CALLs have gone up more than IVs of PUTs. It might indicate there is more CALL buying than PUT buying. From FII data also it is clear, more than 2000 Cr worth options were traded on Friday and this number is at much higher side as compared numbers of recent past. But one should not read too much because it could lead to wrong conclusion unless NIFTY shows clear directional trend. Presently it is clear options are used for hedging by FIIs.

Among all this mixed cues, since bearish signals are more I would like to stay in bear camp.

Buy 7800 NIFTY PUTs.

Hold all bear positions such as BOI, DLF.

Tatamotors:

Tatamotors could go to 430 levels if it goes below ichimoku cloud and as a first step breaks Friday's low.

If it breaks Friday's low the one can set up bear spread strategy in Tatamotors.

Buy 470 PUT around 5.50 and Sell 460 PUT around 3.75.

Maximum loss per lot could be around 1750/- and maximum profit potential Rs. 8250/-

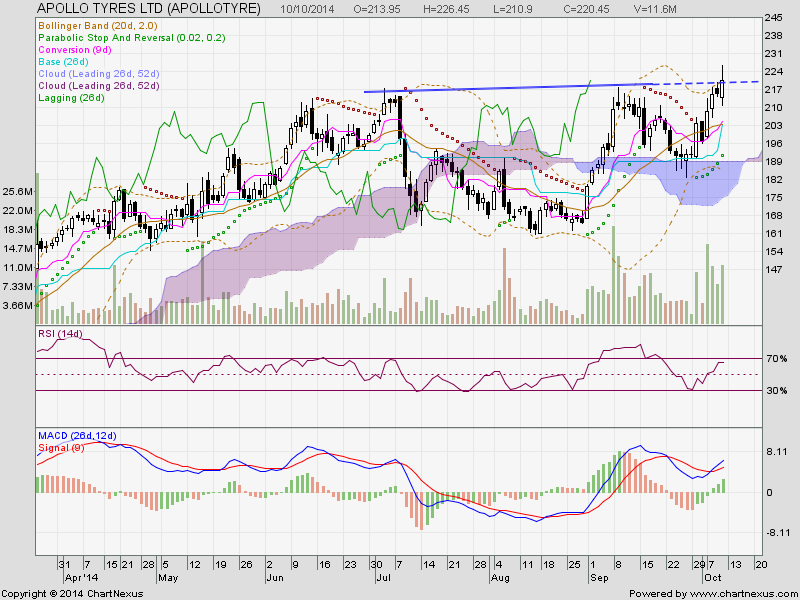

Apollotyres:

Bull spread strategy in Apollotyres.

This stock is recommended on all channels because rubber prices are at multi-year low. This stock gave break-out on Friday and all set for new highs.

Buy 230 CALL around 6/- and sell 240 CALL around 3.25. Maximum loss around 2750 and profit potential above Rs. 7000/-

Disclaimer: This blog does not take any responsibility of your profit/loss.

FIIs are selling in huge quantities and DIIs are buying in equal quantities. NIFTY is not giving any direction. But fundamental rule in trading is one must have one view. Obviously one should be either bullish or bearish.

NIFTY is very near to support level ( 7840-7820), if it goes below 7800, one could see stiff downside till 7650. One could see reversal in short term down-trend from current level. However, one should not do any buying unless NIFTY crosses 7970-7975. See chart.

In OI table one could see more of red spots than green. But still OI analysis is inconclusive. IVs of PUTs and CALLs have gone up. In percentage terms IVs of CALLs have gone up more than IVs of PUTs. It might indicate there is more CALL buying than PUT buying. From FII data also it is clear, more than 2000 Cr worth options were traded on Friday and this number is at much higher side as compared numbers of recent past. But one should not read too much because it could lead to wrong conclusion unless NIFTY shows clear directional trend. Presently it is clear options are used for hedging by FIIs.

Among all this mixed cues, since bearish signals are more I would like to stay in bear camp.

Buy 7800 NIFTY PUTs.

Hold all bear positions such as BOI, DLF.

Tatamotors:

Tatamotors could go to 430 levels if it goes below ichimoku cloud and as a first step breaks Friday's low.

If it breaks Friday's low the one can set up bear spread strategy in Tatamotors.

Buy 470 PUT around 5.50 and Sell 460 PUT around 3.75.

Maximum loss per lot could be around 1750/- and maximum profit potential Rs. 8250/-

Apollotyres:

Bull spread strategy in Apollotyres.

This stock is recommended on all channels because rubber prices are at multi-year low. This stock gave break-out on Friday and all set for new highs.

Buy 230 CALL around 6/- and sell 240 CALL around 3.25. Maximum loss around 2750 and profit potential above Rs. 7000/-

Disclaimer: This blog does not take any responsibility of your profit/loss.

Thursday 9 October 2014

Auropharma 1000 CALL can be bought around 15

NIFTY went up by 100 points during the day but FIIs were net sellers and domestic institutions did most of the buying. This is not very comfortable situation for big up move.

Look at the below NIFTY chart. Unless, it goes above 7995 in spot, refrain yourself from buying anything and book profit in long positions.

Option table is giving contradictory signals but tilted clearly in favor of bulls.

However, follow up action is must.

One has to keep an eye on 8000 PUT contracts during first hour of trading for confirmation of up-trend, otherwise fall again towards 7840 is eminent. Or even it could go further down.

Yesterday option table gave at least some indication of reversal though I had not expected 100 points bounce back, but today though bulls have advantage, 7900 PUT is traded around Rs. 60/- suggesting again support around 7840.

Tomorrow if INFY results and commentary is good, NIFTY could see some momentum during morning session but it is important for NIFTY to held on above 7995.

Hold PUT positions,

Buy safe defensive stocks like Pharma.

Auropharma 1000 CALL can be bought around 15.

Disclaimer: This blog does not take any responsibility of your profit/loss

Look at the below NIFTY chart. Unless, it goes above 7995 in spot, refrain yourself from buying anything and book profit in long positions.

Option table is giving contradictory signals but tilted clearly in favor of bulls.

However, follow up action is must.

One has to keep an eye on 8000 PUT contracts during first hour of trading for confirmation of up-trend, otherwise fall again towards 7840 is eminent. Or even it could go further down.

Yesterday option table gave at least some indication of reversal though I had not expected 100 points bounce back, but today though bulls have advantage, 7900 PUT is traded around Rs. 60/- suggesting again support around 7840.

Tomorrow if INFY results and commentary is good, NIFTY could see some momentum during morning session but it is important for NIFTY to held on above 7995.

Hold PUT positions,

Buy safe defensive stocks like Pharma.

Auropharma 1000 CALL can be bought around 15.

Disclaimer: This blog does not take any responsibility of your profit/loss

Wednesday 8 October 2014

If your risk appetite permits buy NIFTY Future with SL 7830 in cash.

NIFTY:

In spite of all global negativity NIFTY could manage to hold at reasonable level.

As per earlier EW count of mine, 7840 was very important number and NIFTY should not have gone below 7840 as per that count. However, at EOD, NIFTY could mange to close just above 7840, so though it is not technically correct to hold that count now, I would still maintain that count, till NIFTY convincingly closes below 7840 on EOD basis.

FIIs are selling but DIIs are buying and holding NIFTY above 7840.

This is very frustrating period for trading unless NIFTY goes below 7780 or goes above 7950. Hold your breathe till then.

Do not do very active trading unless NIFTY breaks on either side.

Lot of liquidation of 7800 PUTs and hence though strong support still around 7800 as per option table, there is high likelihood that NIFTY might eventually break 7800 level, if and only if, it goes below 7840. Smart option traders were not very confident of holding 7840 in spite of spurt during last hour of trade.

If your risk appetite permits, only for day trading, buy NIFTY Future with SL 7830 in cash. Above 7855 (in cash), NIFTY could have some upside for sure. One should use this opportunity to exit longs. I think so because though OI of CALLs increased phenomenally there is considerable increase in IVs, it is an indication of some CALL buying by powerful hands! Book small profits as broad tone is still negative.

DLF:

It gave sharp bounce back today.

If it crosses 151 in cash, better to book loss or exit at cost in DLF strategy.

BOI

Book profit in 230 PUT contract when BOI goes near 226 in cash.

Disclaimer: This blog does not take any responsibility of your profit/loss

In spite of all global negativity NIFTY could manage to hold at reasonable level.

As per earlier EW count of mine, 7840 was very important number and NIFTY should not have gone below 7840 as per that count. However, at EOD, NIFTY could mange to close just above 7840, so though it is not technically correct to hold that count now, I would still maintain that count, till NIFTY convincingly closes below 7840 on EOD basis.

FIIs are selling but DIIs are buying and holding NIFTY above 7840.

This is very frustrating period for trading unless NIFTY goes below 7780 or goes above 7950. Hold your breathe till then.

Do not do very active trading unless NIFTY breaks on either side.

Lot of liquidation of 7800 PUTs and hence though strong support still around 7800 as per option table, there is high likelihood that NIFTY might eventually break 7800 level, if and only if, it goes below 7840. Smart option traders were not very confident of holding 7840 in spite of spurt during last hour of trade.

If your risk appetite permits, only for day trading, buy NIFTY Future with SL 7830 in cash. Above 7855 (in cash), NIFTY could have some upside for sure. One should use this opportunity to exit longs. I think so because though OI of CALLs increased phenomenally there is considerable increase in IVs, it is an indication of some CALL buying by powerful hands! Book small profits as broad tone is still negative.

DLF:

It gave sharp bounce back today.

If it crosses 151 in cash, better to book loss or exit at cost in DLF strategy.

BOI

Book profit in 230 PUT contract when BOI goes near 226 in cash.

Disclaimer: This blog does not take any responsibility of your profit/loss

Tuesday 7 October 2014

Update

NIFTY

General tone is negative.

FIIs are net sellers in cash and F & O.

Will NIFTY go near 7700?

See NIFTY chart. Double top pattern had failed many times earlier in many stocks and indices. This would invariably happen in bull market. If it works this time then only NIFTY could reach 7700.

Option traders are also convinced about bearishness.

But notice lot of addition of 7800 PUT, which was trading around 73-74 at EOD. This means, according to option traders even in case of extreme bearishness also NIFTY might not go below 7726 in near future.

Hold NIFTY 7700 PUTs and book profit if NIFTY goes sub 7800 level.

DLF:

As per chart, very bearish. Next support around 136/130/126/ 120. But these are weak support levels.

But what was interesting today, a lot of PUT addition at 140 PUT and it is traded around Rs.5/-. So DLF might not go below 135 according to the smart option traders.

Book profit in DLF strategy when DLF would go near 136 in cash.

BOI

It should go below 221.

Next target could be 202.

OI table is also very bearish.

Part book if BOI touches Rs. 222-221 in cash and hold other lots till sub 210 level.

Disclaimer: This blog does not take any responsibility of your profit/loss.

General tone is negative.

FIIs are net sellers in cash and F & O.

Will NIFTY go near 7700?

See NIFTY chart. Double top pattern had failed many times earlier in many stocks and indices. This would invariably happen in bull market. If it works this time then only NIFTY could reach 7700.

Option traders are also convinced about bearishness.

But notice lot of addition of 7800 PUT, which was trading around 73-74 at EOD. This means, according to option traders even in case of extreme bearishness also NIFTY might not go below 7726 in near future.

Hold NIFTY 7700 PUTs and book profit if NIFTY goes sub 7800 level.

DLF:

As per chart, very bearish. Next support around 136/130/126/ 120. But these are weak support levels.

But what was interesting today, a lot of PUT addition at 140 PUT and it is traded around Rs.5/-. So DLF might not go below 135 according to the smart option traders.

Book profit in DLF strategy when DLF would go near 136 in cash.

BOI

It should go below 221.

Next target could be 202.

OI table is also very bearish.

Part book if BOI touches Rs. 222-221 in cash and hold other lots till sub 210 level.

Disclaimer: This blog does not take any responsibility of your profit/loss.

Friday 3 October 2014

Buy 7800 PUTs for next week with strict SL.

There seems to be lot of confusion in traders. Last three days though there were no perfect Doji candles, opening and closing prices were more or less same.

NIFTY could show 200-225 points move non either side after opening on Tuesday till weekend. RSI near oversold could see slight bounce back, but over all trend seems to be negative for very short term. And here is the reasoning for this hypothesis.

FIIs are selling in cash though buying in F & O segment to hedge their bets.

Global markets were negative and Singapore NIFTY touched 7760. But it is important to note, slight recovery in global market could see quick 100 points gain in SGX NIFTY. So there is lot of positive sentiments and hopes on Modi Government. His (Modi) speeches, cleanliness drive, meetings with US leaders etc. everything is being propagated by media and this will keep morale of traders very high.

But what was in minds of so called professional smart option traders by end of trading session on October 01?

Look at the OI table of October 01.

Resistance at 8200 and support around 7800.

But you would notice lot of unwinding of PUT contracts from 7850 to 8200. OI has decreased considerably. So in simple term either former seller has bought or former buyer has sold. In any trade or for that matter in any business or browse there should be one winner and one loser. "Win-Win" trade is good terminology for McKinsey's of the world, in reality there is one persons wins and other loses.

Generally falling OI will indicate that loser are exiting. Loser abandons the hope and new loser is unwilling to take the risk. This is a first sign of an exhaustion of the trend.

In this case of OI table of October 1, this is precisely the story.

PUT sellers (bulls) could not find new bulls on October 1 in many contracts (eg. PUT contracts from 7850 to 8200), and hence open interest went down. Study table minutely and one can notice IVs also gone down reasonably so these must be PUT sellers (bulls) and this strengthens the view of creeping bearishness.

As mentioned earlier, strong support around 7800 and 7800 PUT is being traded around 50, so NIFTY should not go down below 7750 immediately.

With this view, stay foot in all bear positions such as BOI 230 PUT, DLF PUT etc.

Buy 7800 PUTs for next week with strict SL.

No other new trade on Tuesday, I will study market dynamics on Tuesday and then take new positions.

Disclaimer: This blog does not take any responsibility of your profit/loss

NIFTY could show 200-225 points move non either side after opening on Tuesday till weekend. RSI near oversold could see slight bounce back, but over all trend seems to be negative for very short term. And here is the reasoning for this hypothesis.

FIIs are selling in cash though buying in F & O segment to hedge their bets.

Global markets were negative and Singapore NIFTY touched 7760. But it is important to note, slight recovery in global market could see quick 100 points gain in SGX NIFTY. So there is lot of positive sentiments and hopes on Modi Government. His (Modi) speeches, cleanliness drive, meetings with US leaders etc. everything is being propagated by media and this will keep morale of traders very high.

But what was in minds of so called professional smart option traders by end of trading session on October 01?

Look at the OI table of October 01.

Resistance at 8200 and support around 7800.

But you would notice lot of unwinding of PUT contracts from 7850 to 8200. OI has decreased considerably. So in simple term either former seller has bought or former buyer has sold. In any trade or for that matter in any business or browse there should be one winner and one loser. "Win-Win" trade is good terminology for McKinsey's of the world, in reality there is one persons wins and other loses.

Generally falling OI will indicate that loser are exiting. Loser abandons the hope and new loser is unwilling to take the risk. This is a first sign of an exhaustion of the trend.

In this case of OI table of October 1, this is precisely the story.

PUT sellers (bulls) could not find new bulls on October 1 in many contracts (eg. PUT contracts from 7850 to 8200), and hence open interest went down. Study table minutely and one can notice IVs also gone down reasonably so these must be PUT sellers (bulls) and this strengthens the view of creeping bearishness.

As mentioned earlier, strong support around 7800 and 7800 PUT is being traded around 50, so NIFTY should not go down below 7750 immediately.

With this view, stay foot in all bear positions such as BOI 230 PUT, DLF PUT etc.

Buy 7800 PUTs for next week with strict SL.

No other new trade on Tuesday, I will study market dynamics on Tuesday and then take new positions.

Disclaimer: This blog does not take any responsibility of your profit/loss

Subscribe to:

Posts (Atom)