NIFTY is maintaining positive momentum. It has reached in resistance zone but one can never be certain about a reversal.

For being cautious, one should exit from

- Auropharma

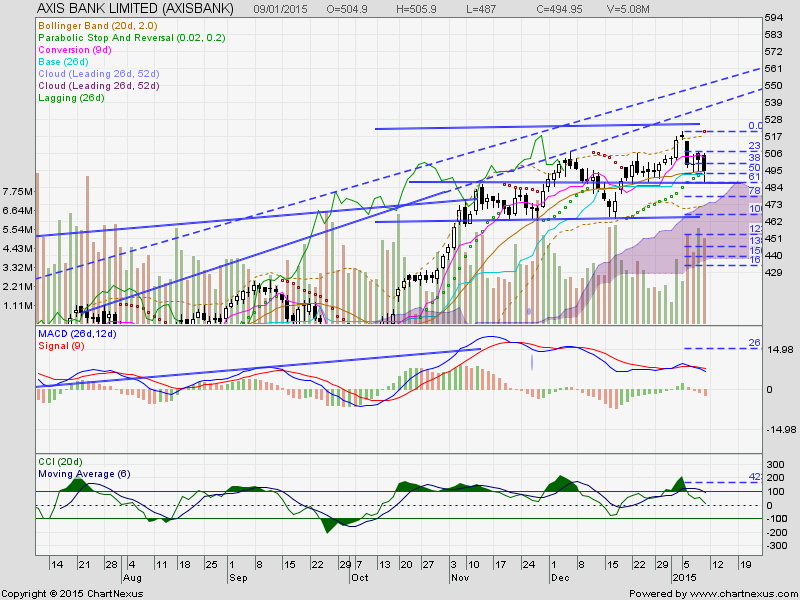

- AXISBANK

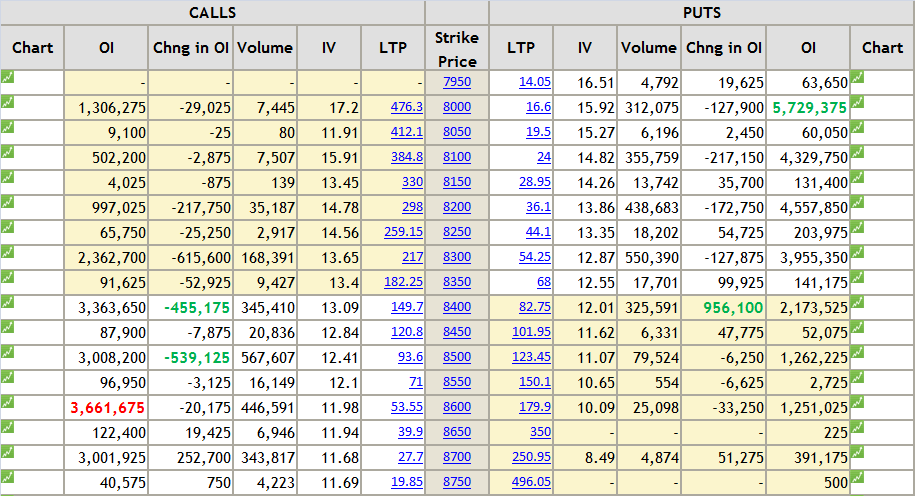

- NIFTY 8300 PUT sell contracts. Book profits if not booked earlier.

- and Book marginal loss in 8500 CALL sell contract too.

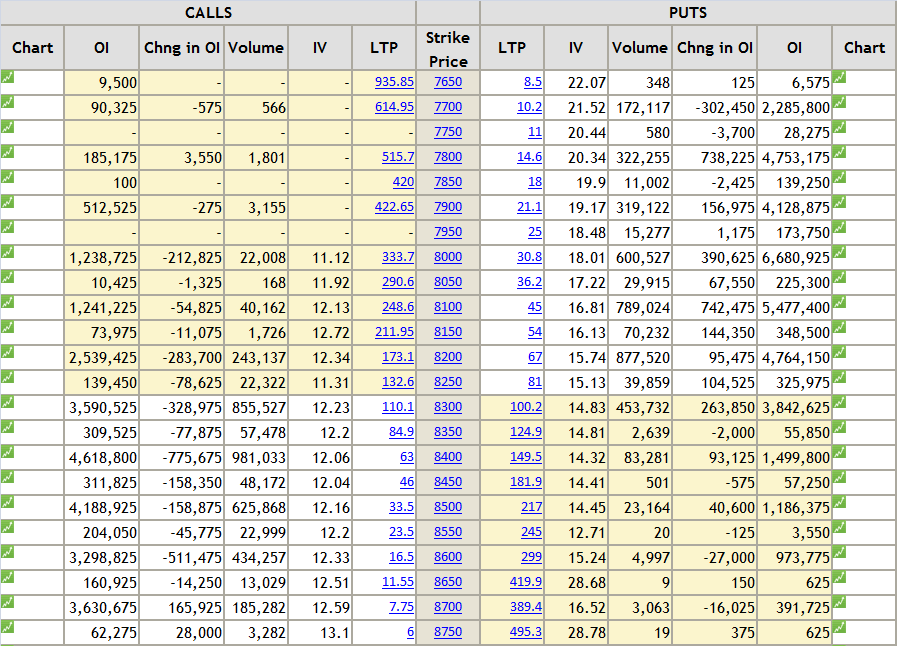

NIFTY

8485-8550 is a band from where it could turn back. See chart.

Lot of addition in 8400 PUTs will ensure NIFTY will cross 8400 on Monday.

No new trade in NIFTY at present, but would try to sell OTM CALLs if NIFTY goes above 8550 during the week.

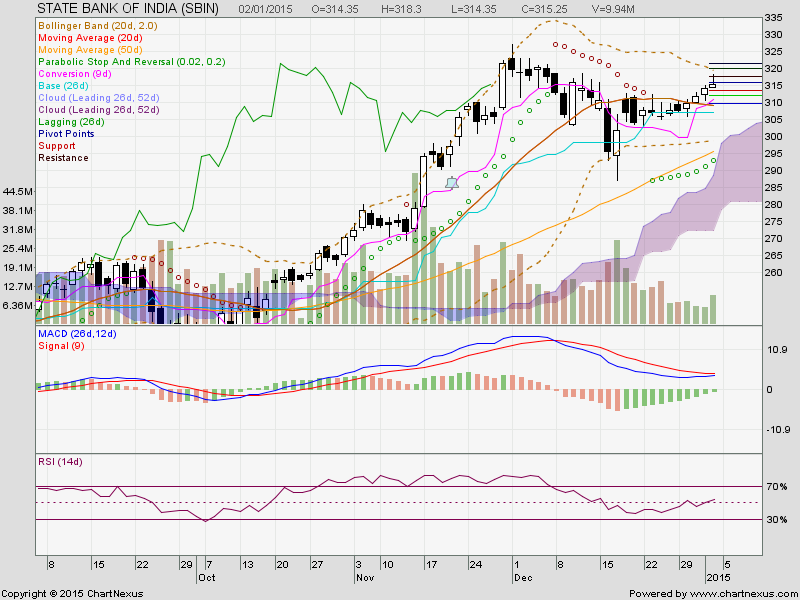

SBIN:

Merger with IDBI could have positive impact? Could it help to reduce NPAs? I am not sure looking at OI table on Friday. I am worried about 315 PUT sell contract and if stock is not moving in desired direction I will try to exit.

Lot of addition at higher strike CALL contracts. Whether they are CALL sell contracts or they are CALL buyers? I have not noticed considerable increase in IVs and I am afraid to brand them as buyers.

The stock as gone up with volumes on Friday, but could not sustain at higher levels and closed near day open. All this is not very pleasant situation for the bulls. Let us decide about SBIN on Monday.

Who knows investors could find SBIN good as a long term bet and stock could move past 320, giving us profit booking opportunity?

2.5 shares of IDBI stock holder is going to get one SBI stock. IDBI trading at much discounted price and could see good positive momentum compared to SBI on Monday.

ONGC:

It started picking up.

Hold 360 CALL contract and try to book profit near 12-15 zone during next week.

This stock has potential to cross 400 in cash in near future.

No new positions on Monday.

Look for selling OTM CALLS in NIFTY if NIFTY goes near 8550.

Disclaimer: This blog does not take any responsibility of your profit/loss