After reasonably good last month we have to set new trades for the month, without being over confident with the success in the fourth consecutive month.Markets are great levelers and over confidence, ego are perfect ingredients for recipe for failure. So in short, we have to forget successes, stick to trading discipline followed in last months and JUST DO IT AGAIN.

I personally could not capture bigger gains in many trades last month but I had no reason for complain as gains were much more than bank FD interest.

NIFTY:

NIFTY corrected from retracement level and there is still further scope for some downward moment.

One should have view on NIFTY to trade effectively in market.

My view is NIFTY might not go down too much below 8000 in January, at the same time crossing earlier high at least in first two weeks in January could be difficult for the NIFTY.

Another big assumption and I must confess here, this is without any big study, and based on hearsay information is, oil prices will stabilize around 60 or even could start upward movement in January 2015!

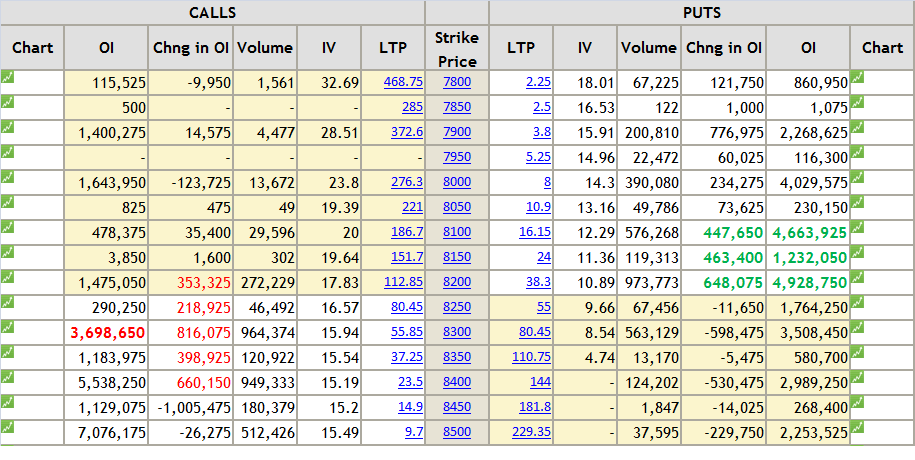

Now look at OI analysis of NIFTY.

One can see presently 8400 is strong resistance and 8000 is very strong support.

Even on NIFTY chart, it is evident that NIFTY has strong support near 8050.

STOCKS:

Capital good stocks might not do well because generally their order book is full of orders from Gulf countries and due to crude oil pricing it could shrink.

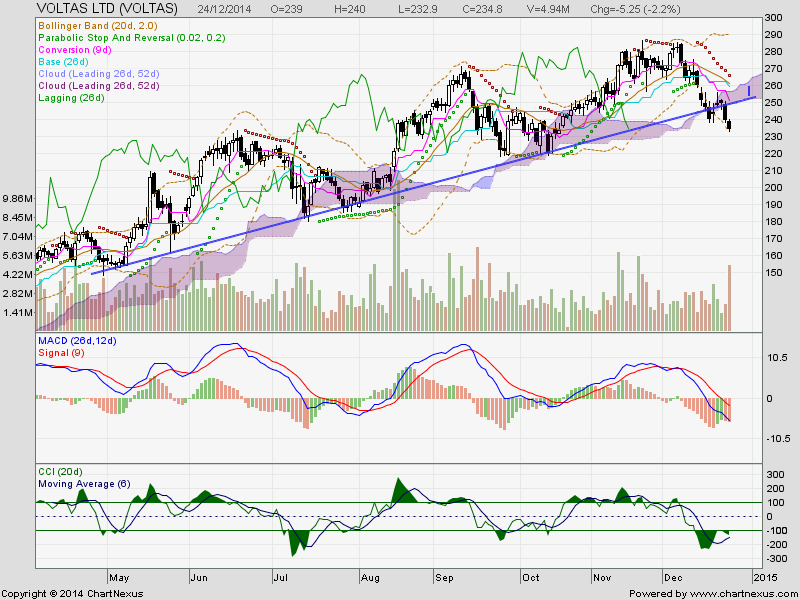

Voltas could suffer due to lack of orders and might correct a bit. It has broken long time support line and now comfortably trading below cloud. See the volumes with which it has fallen on Thursday.

Banking:

Banking stocks will merry.

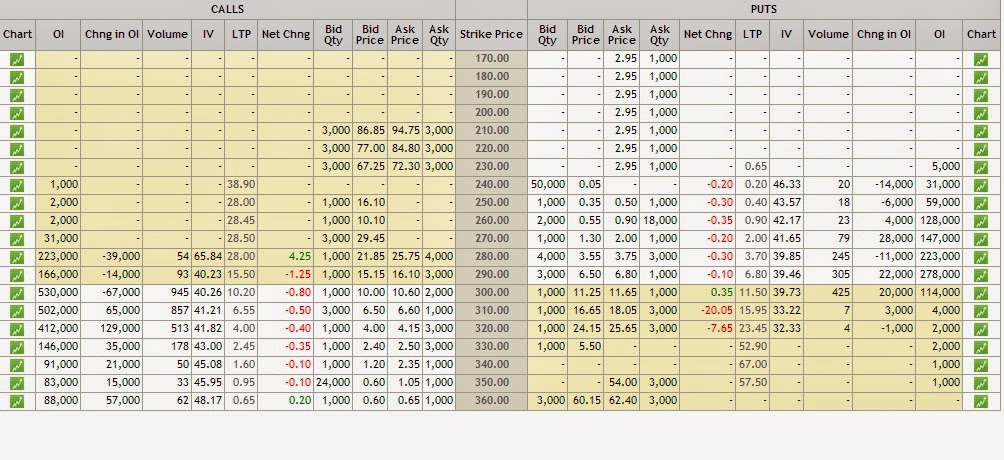

Axisbank:

Axis bank is moving in channel. If it breaks the channel, means if it crosses 505-507 it could zoom to 540.

Lot of long built up in Axisbank and short term trader should take advantage of that.

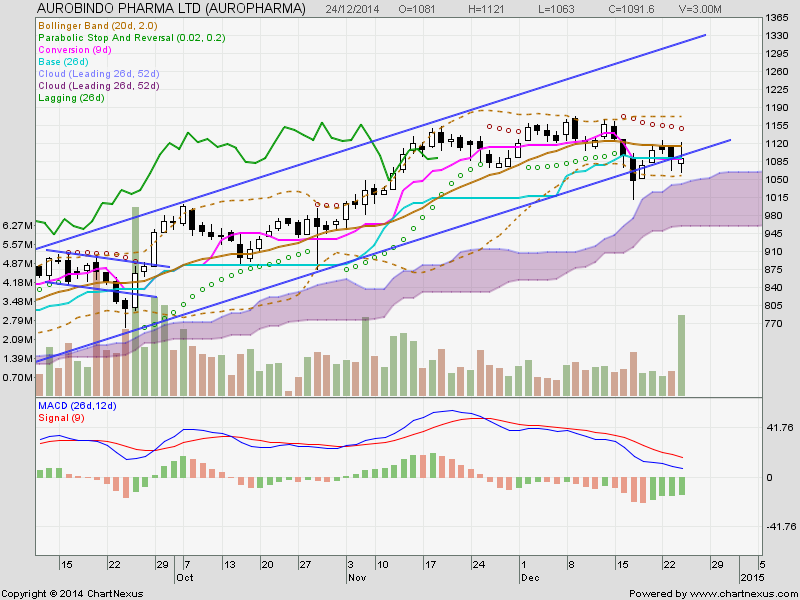

Aurobindo:

This stock is all set to touch 1250-1300, ie upper end of the channel, unless there are any authority (FDA) issues in January. Look at the volume with which it closed on Thursday.

ONGC:

If oil price stabilizes and if Government gave any indication of disinvestment, ONGC has a potential to go near 400 in January. See MACD cross over.

Based on this background our trades for next 5-6 trading sessions are as follows:

1. Sell NIFTY 8300 PUT 4 lots

2. Sell NIFTY 8500 CALL 4 lots

3, Sell VOLTAS 250 CALL between 8-10

This should credit your account by about 25000/-

4. Buy AXISBANK 500 CALL around 14-16

5. Buy AUROPHARMA (Aurobindo) 1120 CALL around 35-45

6. Buy ONGC 360 CALL

I will update trades regularly, but to start with one should enter in all 6 trades at the same time.

Disclaimer: This blog does not take any responsibility of your profit/loss