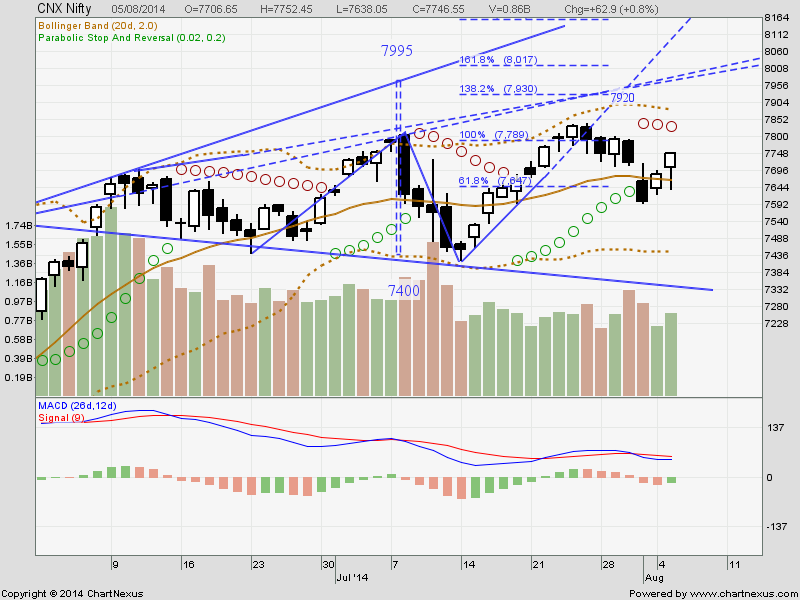

NIFTY is forming higher high on daily basis.

Japan visit of NAMO is one trigger, US visit could be another. Nobody is willing to hear any adverse news, no one is caring for SC judgement for coal allocations. All problems of our country have vanished and there is hope that whatever small issues such as inflation, decreasing IIP, supply scarcity, bank NPAs, current account deficit, unequal rain, rising dollar-falling rupee etc are remaining, those will be taken care of by this new Government.

But as a short term trader one should not try to read too much and worried about future. He should just ride on sentiments and liquidity, and he should learn to ignore fundamentals. This could be for investors who think for September 2015, 2016, not for us who are keen to anticipate what will happen in September 2014.

NIFTY

If NIFTY crosses 8000 mark on Monday, it could reach 8170 levels very soon. So plan your retracement trades accordingly.

Bull spread strategy in NIFTY

Buy 8100 CALL around 55 and sell 8200 CALL around 30.

Maximum loss would be Rs. 1250 and maximum profit potential could be around Rs. 3750. This is reasonably safe strategy and one should enter as many lots as possible and book profit as soon as one sees 2% gain.

It will be extremely difficult for NIFTY to cross 8300 before expiration so keep accumulating NIFTY 8300 CALL sell contracts starting from Rs. 20/-

Reliance:

It is in general uptrend!

There are various ways one can trade depending upon risk appetite.

Maybe new 3rd wave is staring, with 161% retracement target around 1065 in cash.

1) Buy Reliance future with SL 975 in cash. OR

2) Buy Reliance 1040 CALL around Rs. 13-15, Maximum loss Rs. 3750. Book profit around 25-27-35 within next 5-7 trading sessions or see for cash price reaching 1065 level to book profit OR

3) Bull spread strategy:

Buy 1000 CALL around 30/- Sell 1060 CALL around 8/-; maximum loss Rs. 5500/- maximum profit around Rs. 9500/-

DLF:

DLF is in down trend. It is well set to go to 149-150

One can trade multiple ways.

1) buy 150 PUT around Rs. 1.50/-, maximum loss Rs. 3000/-

2) bear spread strategy: Buy 170 PUT around Rs. 5/- and sell 160 PUT around Rs. 2.75

Maximum loss 5200-5400/- maximum profit Rs. 15000/-

3) Sell future with SL 177 in cash.

One can even combine Reliance and DLF trades:

Buy Reliance 1000 CALL around 30 and buy DLF 170 PUT around Rs. 5/- Maximum loss Rs. 17500-18000/- but unlimited profit potential.

OR

Buy Reliance 1040 CALL around 13 and buy DLF 160 PUT around Rs. 2.75. Maximum loss Rs. 9500-10000/- , however, unlimited profit potential.

Disclaimer: This blog does not take any responsibility of your profit/loss

Japan visit of NAMO is one trigger, US visit could be another. Nobody is willing to hear any adverse news, no one is caring for SC judgement for coal allocations. All problems of our country have vanished and there is hope that whatever small issues such as inflation, decreasing IIP, supply scarcity, bank NPAs, current account deficit, unequal rain, rising dollar-falling rupee etc are remaining, those will be taken care of by this new Government.

But as a short term trader one should not try to read too much and worried about future. He should just ride on sentiments and liquidity, and he should learn to ignore fundamentals. This could be for investors who think for September 2015, 2016, not for us who are keen to anticipate what will happen in September 2014.

NIFTY

If NIFTY crosses 8000 mark on Monday, it could reach 8170 levels very soon. So plan your retracement trades accordingly.

Bull spread strategy in NIFTY

Buy 8100 CALL around 55 and sell 8200 CALL around 30.

Maximum loss would be Rs. 1250 and maximum profit potential could be around Rs. 3750. This is reasonably safe strategy and one should enter as many lots as possible and book profit as soon as one sees 2% gain.

It will be extremely difficult for NIFTY to cross 8300 before expiration so keep accumulating NIFTY 8300 CALL sell contracts starting from Rs. 20/-

Reliance:

It is in general uptrend!

There are various ways one can trade depending upon risk appetite.

Maybe new 3rd wave is staring, with 161% retracement target around 1065 in cash.

1) Buy Reliance future with SL 975 in cash. OR

2) Buy Reliance 1040 CALL around Rs. 13-15, Maximum loss Rs. 3750. Book profit around 25-27-35 within next 5-7 trading sessions or see for cash price reaching 1065 level to book profit OR

3) Bull spread strategy:

Buy 1000 CALL around 30/- Sell 1060 CALL around 8/-; maximum loss Rs. 5500/- maximum profit around Rs. 9500/-

DLF:

DLF is in down trend. It is well set to go to 149-150

One can trade multiple ways.

1) buy 150 PUT around Rs. 1.50/-, maximum loss Rs. 3000/-

2) bear spread strategy: Buy 170 PUT around Rs. 5/- and sell 160 PUT around Rs. 2.75

Maximum loss 5200-5400/- maximum profit Rs. 15000/-

3) Sell future with SL 177 in cash.

One can even combine Reliance and DLF trades:

Buy Reliance 1000 CALL around 30 and buy DLF 170 PUT around Rs. 5/- Maximum loss Rs. 17500-18000/- but unlimited profit potential.

OR

Buy Reliance 1040 CALL around 13 and buy DLF 160 PUT around Rs. 2.75. Maximum loss Rs. 9500-10000/- , however, unlimited profit potential.

Disclaimer: This blog does not take any responsibility of your profit/loss