Budget week!

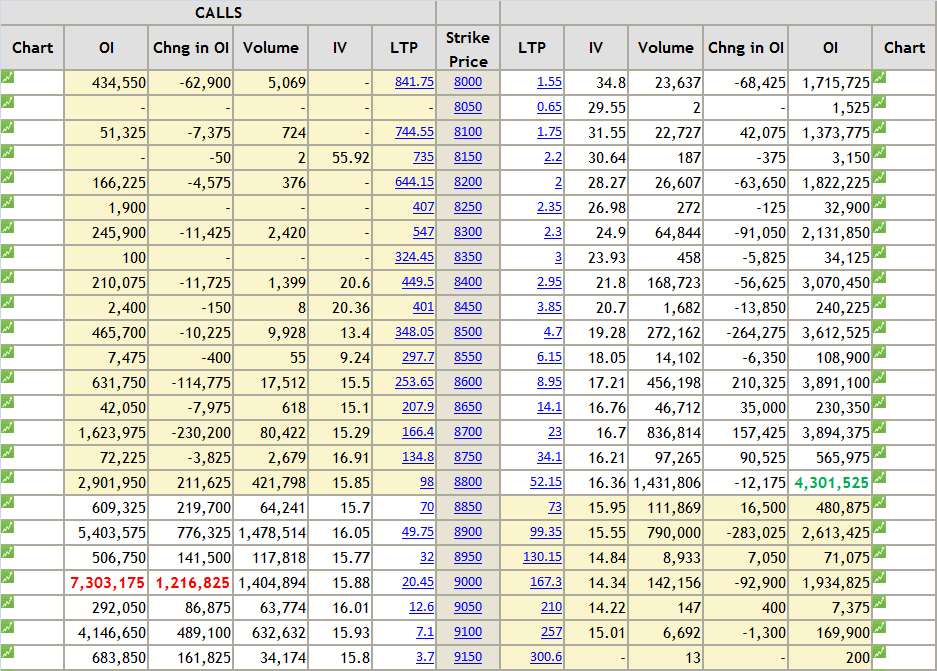

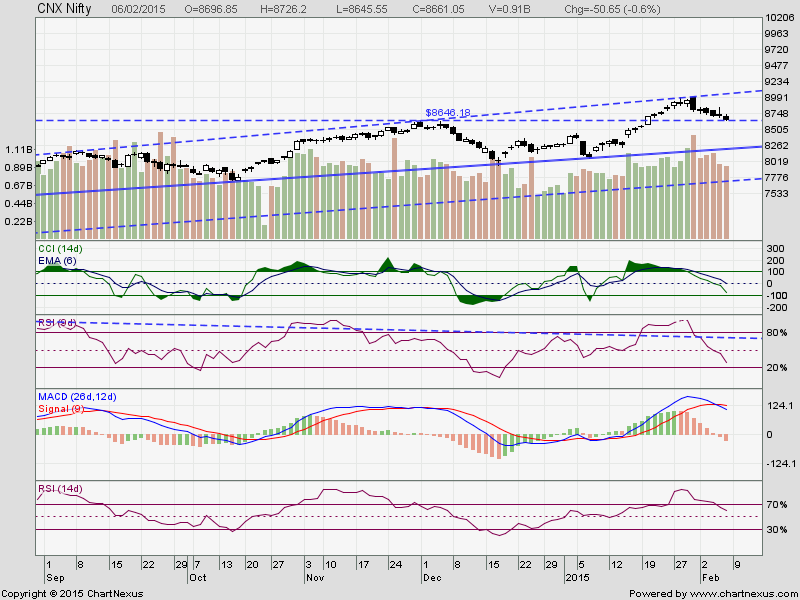

Lot of expectations about Budget are built in already in NIFTY price. Traders are cautious. FIIs are buyers. NIFTY rallied and covered 350-400 points and now consolidating during last three trading sessions. For NIFTY, 8800 should act as a good psychological support.

Averages are catching up. RSI (14 D) is near 40-45 and approaching oversold region. Hope rally could be at his best in its last stride and post budget NIFTY could cross 9300 at least once. And looking at chart and OI table, immediate range till expiration could be 8800 (+50) to 9000 (+50)

Based on this assumptions:

Sell 4 lots of NIFTY 9000 PUT of February expiration in the range of 150-200.

Reliance:

Due to adverse news about steeling information, Reliance could struggle for some more time. It has immediate support of 830.

Buy 860 PUT between 6-7.

ICICIBANK

Stock is not doing well. In general banking and especially private banks did not participate in brief rally last week. Maybe they will do so this week.

ICICIBANK has strong support around 320 and resistance around 360. It should try to touch both levels in next four trading sessions.

Maximum OI in 330 PUT and which is being traded at 5.50, this could mean stock many not go too much below 324-325. That would be the time to enter in to 330 CALL buy contract.

As per rough calculation 330 CALL should be available around 3.25-4.00, if stocks goes near 325 in cash segment on Monday

Buy 330 ICICI BANK CALL of February expiration around 3.25-4.00.

In short, trades should be as follows:

1) Sell four lots of 9000 NIFTY PUT around 150-200

2) Buy Reliance 860 PUT around 6-7

3) Buy ICICIBANK 330 CALL between 3.25-4.50.

Hold these trades till expiration of this month.

Disclaimer: This blog does not take any responsibility of your profit/loss

Lot of expectations about Budget are built in already in NIFTY price. Traders are cautious. FIIs are buyers. NIFTY rallied and covered 350-400 points and now consolidating during last three trading sessions. For NIFTY, 8800 should act as a good psychological support.

Averages are catching up. RSI (14 D) is near 40-45 and approaching oversold region. Hope rally could be at his best in its last stride and post budget NIFTY could cross 9300 at least once. And looking at chart and OI table, immediate range till expiration could be 8800 (+50) to 9000 (+50)

Based on this assumptions:

Sell 4 lots of NIFTY 9000 PUT of February expiration in the range of 150-200.

Reliance:

Due to adverse news about steeling information, Reliance could struggle for some more time. It has immediate support of 830.

Buy 860 PUT between 6-7.

ICICIBANK

Stock is not doing well. In general banking and especially private banks did not participate in brief rally last week. Maybe they will do so this week.

ICICIBANK has strong support around 320 and resistance around 360. It should try to touch both levels in next four trading sessions.

Maximum OI in 330 PUT and which is being traded at 5.50, this could mean stock many not go too much below 324-325. That would be the time to enter in to 330 CALL buy contract.

As per rough calculation 330 CALL should be available around 3.25-4.00, if stocks goes near 325 in cash segment on Monday

Buy 330 ICICI BANK CALL of February expiration around 3.25-4.00.

In short, trades should be as follows:

1) Sell four lots of 9000 NIFTY PUT around 150-200

2) Buy Reliance 860 PUT around 6-7

3) Buy ICICIBANK 330 CALL between 3.25-4.50.

Hold these trades till expiration of this month.

Disclaimer: This blog does not take any responsibility of your profit/loss