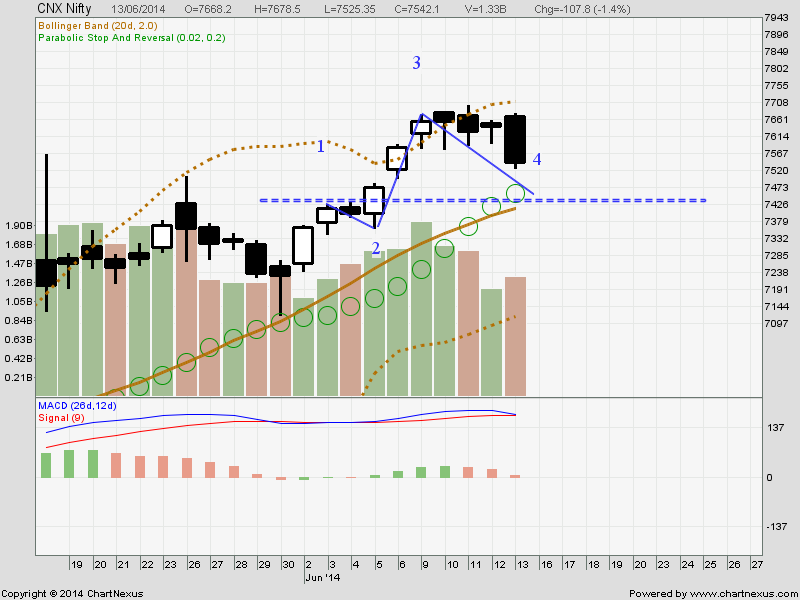

After reasonably good last month, let us start new series with caution ahead of budget.

Personally, I don't expect too much upside movement from here unless there is any surprising announcement by Government.

Everything seems to be factored in by now. Monsoon is still not active. Iraq issue is worsening. Russia and Putin are still not sitting quiet. Commodity prices going up, Rupee again started depreciating. Rail rate hike and subsequent roll back is not taken seriously so far by investors and was supported by good media management by NAMO Government. But somewhere it would stop soon.

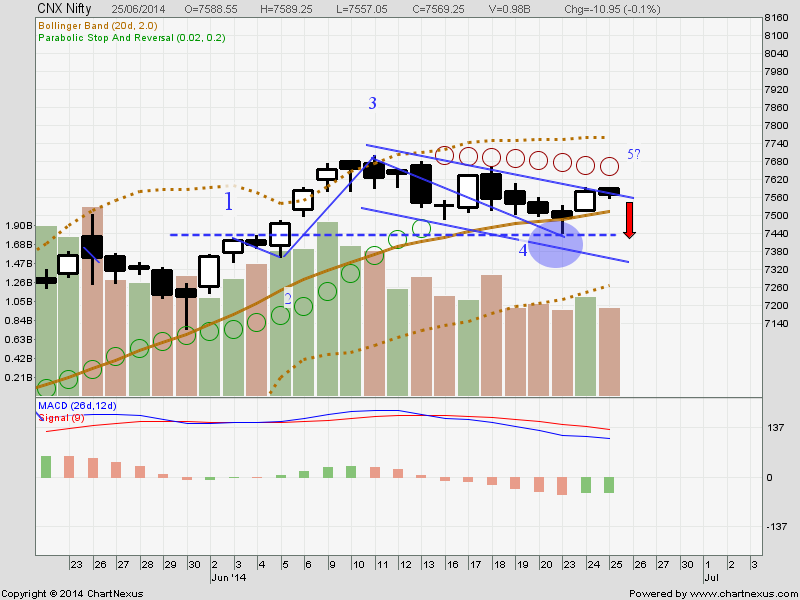

So as per present view NIFTY will not cross 8000 and will not go below 7100.

Short strangle:

Sell 8000 CALL around 18-20 and sell 7100 PUT between 18-20. Delta is near zero and today it seems to be very safe strategy.

Due to budget there could be some risk involved but it is reasonably low.

NIFTY movement more than 10 % seems impossible and if it happens we will publish delta values and adjust trades accordingly.

Those who want to stay very safe can enter such delta trade after budget announcement.

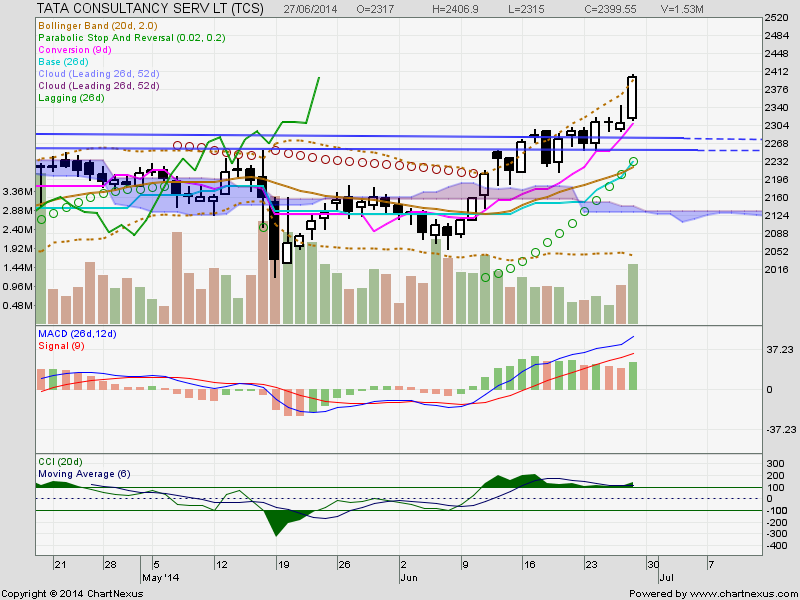

TCS:

You will notice TCS has good support in the range of 2250.

Sell 2250 PUT around 30.

Hold the trade till it reaches target around 17-18 or till stock goes below 2250 in cash.

Disclaimer: This blog does not take any responsibility of your profit/loss.

Personally, I don't expect too much upside movement from here unless there is any surprising announcement by Government.

Everything seems to be factored in by now. Monsoon is still not active. Iraq issue is worsening. Russia and Putin are still not sitting quiet. Commodity prices going up, Rupee again started depreciating. Rail rate hike and subsequent roll back is not taken seriously so far by investors and was supported by good media management by NAMO Government. But somewhere it would stop soon.

So as per present view NIFTY will not cross 8000 and will not go below 7100.

Short strangle:

Sell 8000 CALL around 18-20 and sell 7100 PUT between 18-20. Delta is near zero and today it seems to be very safe strategy.

Due to budget there could be some risk involved but it is reasonably low.

NIFTY movement more than 10 % seems impossible and if it happens we will publish delta values and adjust trades accordingly.

Those who want to stay very safe can enter such delta trade after budget announcement.

TCS:

You will notice TCS has good support in the range of 2250.

Sell 2250 PUT around 30.

Hold the trade till it reaches target around 17-18 or till stock goes below 2250 in cash.

Disclaimer: This blog does not take any responsibility of your profit/loss.