NIFTY has moved phonemically in very short time and many would have missed this rally. Lot of volatility was expected and hence I stayed away from usual CALL sell strategies.

After memorable last month (thanks to DLF), strategies are bit differently this month.

Let us analyse new strategy practically everyday and book profit/loss at end of the week or decide further course of action based on market direction then,

One should enter in all six trades together.

We should write CALLs and PUTs, gain some premium and then buy CALLs and PUTs to maintain credit balance in trading account at least to start with.

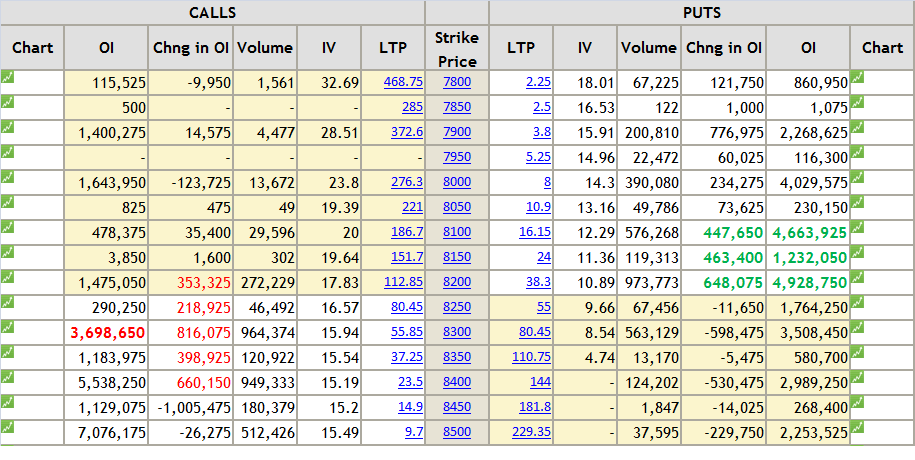

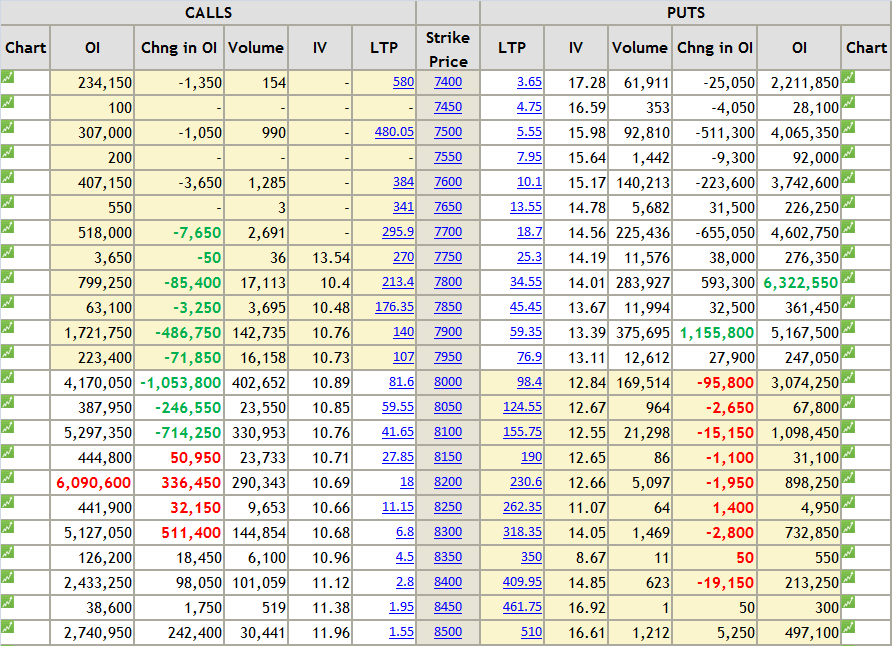

Like everybody, my general view is up, as per OI, NIFTY entered in new series with very positive bias, but I personally don't think NIFTY will go above 8490-8500 in this series.

Lot of CALLs written at higher level. Maybe some profit booking could be seen at higher level and NIFTY could see 8200 in next 7-8 trading sessions.

But individual stocks could move up to find new highs. IT stocks could show slow momentum. Though Rupee is depreciating, very soon it could come near 60/- and some profit booking could be seen in IT stocks.

INFOSYS:

It is near resistance line.

May give breakout and could zoom to 4100 but should hold 4150 for temporary period.

The highest OI at 4100 and 4200 should act as strong resistance.

In short one can sell INFY 4100 CALL around 72-80 to gain premium about 9300/-

and sell NIFTY 8300 CALLs around 140/-, One can sell total 5 CALLs to gain premium about 17000/-

So you trading account will be credited by Rs. 28000-29000/-

In this money we should find stocks which could outperform NIFTY.

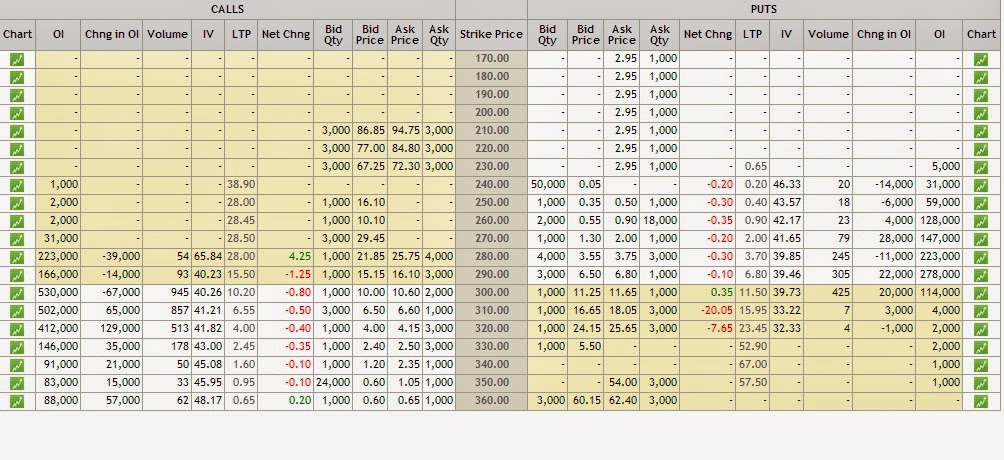

DISHTV:

DISHTV Stock is not doing too much in past several month. In true sense never participated in the rally.

Maybe it will do this in the last leg of the rally and has a potential to touch 65-66.

Buy DISHTV 60 CALL around 1.40

AXISBANK:

It was moving in channel for some time and gave clear breakout on October 31. Has huge upside potential.

Buy AXISBANK 450 CALL around 7.50-8.00

Ranbaxy:

Ranbaxy management is known for surprises for their dealings with USFDA. In esomprazole, to avail 180 days exclusivity they must able to launch on November 25. If they don't it could be substantial loss to Ranbaxy, analysts are expecting it could be in the range of USD 300-400 mio, which could be about 10% of total Ranbaxy's business. Drop in share price if Ranbaxy could not succeed in launching esomprazole, could be around 20% including sentimental blow from traders.

But if Ranbaxy could launch, in this bull market stock will go up to 725-730 on November 26.

As an option trader one should have positions on both sides and must hold till November 26.

Buy Ranbaxy 650 CALL around 14/- and buy Ranbaxy 6200 PUT around 12.

In short trades should be as follows.

- Sell INFY 4100 CALL, 1 lot

- SELL NIFTY 8300 CALL, 5 lots

- Buy DISHTV 60 CALL, 1 lot

- BUY AXISBANK 450 CALL, 1 lot

- Buy RANBAXY 620 PUT, 1 lot

- Buy RANBAXY 650 CALL, 1 lot

Disclaimer: This blog does not take any responsibility of your profit/loss